Recent reports have surfaced indicating that the cryptocurrency exchange Gemini is contemplating an initial public offering (IPO) within the year. As disclosed by Bloomberg News, individuals with insight into the situation reveal that the company is in discussions with potential advisers about this move; however, an official decision has yet to be finalized. The consideration of an IPO reflects a broader trend within the cryptocurrency sector, signaling that many firms are seeking public capital as they grow and restructure.

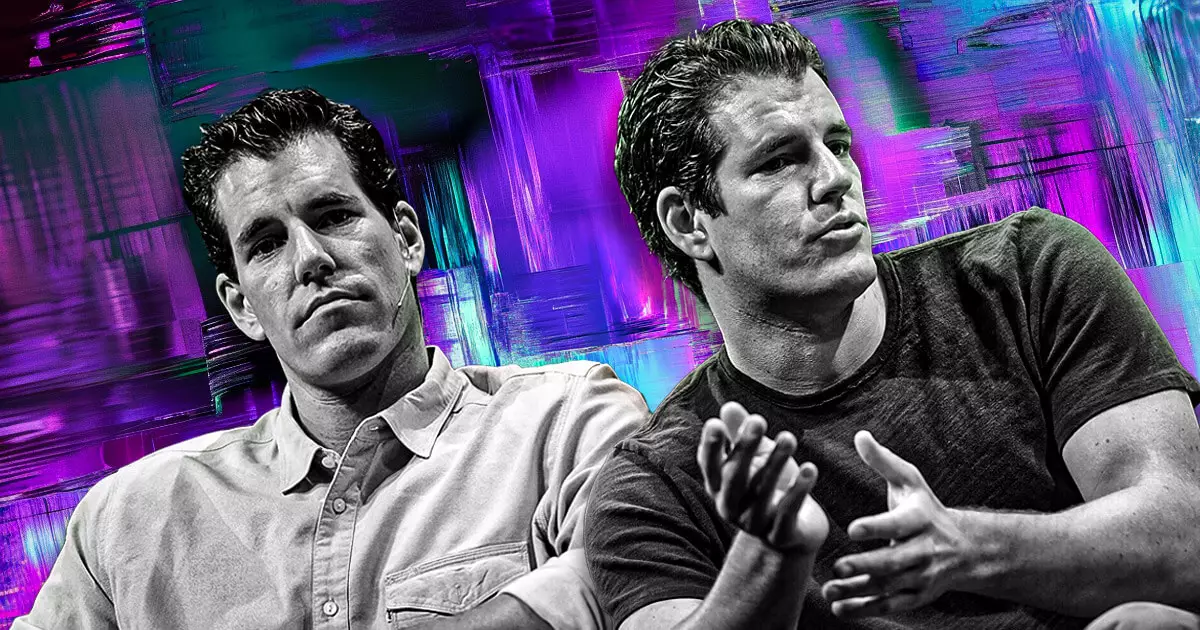

Market analysts, including Bloomberg’s James Seyffart, suggest that the current political environment under the Trump administration has created favorable conditions for cryptocurrency enterprises. This assertion aligns with the Winklevoss twins, co-founders of Gemini, who have publicly shown support for Trump by donating Bitcoin exceeding the maximum contribution limit, a gesture that ultimately received a refund on the surplus. Such movements within the crypto community could indicate a shift towards greater acceptance and integration of digital currencies into mainstream finance, generating optimism about forthcoming IPOs.

Despite the optimistic outlook, Gemini has faced its share of hurdles. The exchange has dealt with complicated legal and regulatory issues, recently culminating in a settled lawsuit with the Commodity Futures Trading Commission (CFTC) for $5 million. The CFTC accused Gemini of providing misleading information during its attempts to launch the first U.S.-regulated Bitcoin futures contract. Moreover, the firm’s decision to withdraw from the Canadian market illustrates the difficulties it faces in navigating international regulatory frameworks. Such exits are not unique to Gemini, as other crypto firms like Bybit and Binance have made similar decisions in light of tightening regulations.

On a more positive note, while retracting from certain markets, Gemini has made strides by securing a license in Singapore. This move allows the exchange to offer cross-border money transfer and digital payment token services, highlighting the country’s receptive attitude towards cryptocurrency innovation. Countries like Singapore are becoming hubs for crypto activity, witnessing the growth of various firms, including OKX and Coinbase, who are expanding operations in its jurisdiction amidst increasing regulatory pressure in other territories.

As Gemini evaluates its potential IPO and navigation through extensive regulatory landscapes, the future remains complex yet full of promise. The convergence of political support, emerging market opportunities, and ongoing challenges will shape its trajectory. The developments in Gemini’s business strategy and the broader crypto ecosystem could influence not only its standing but also the fate of many other cryptocurrency companies considering similar paths toward public listing. The crypto market is at a critical juncture, and companies like Gemini play a pivotal role in its evolution.