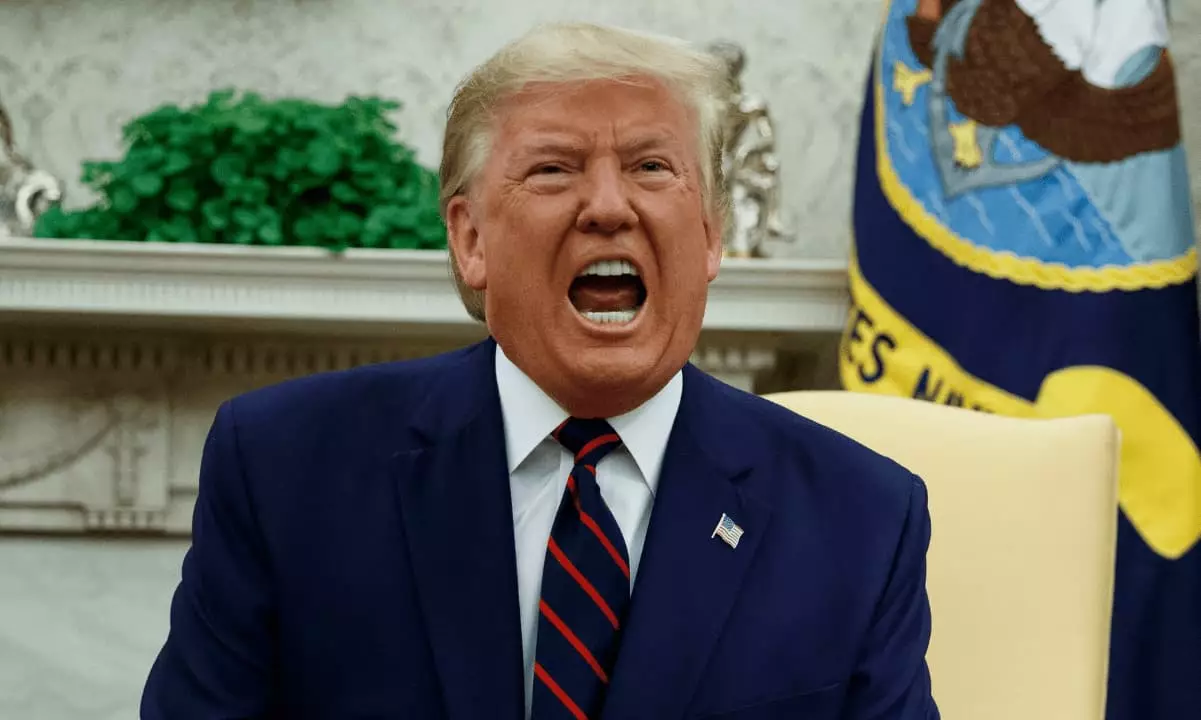

In an age where digital currencies and decentralized finance are altering the economic landscape, the involvement of political figures in this world raises profound moral and ethical questions. President Donald Trump’s foray into cryptocurrency and fundraising exemplifies this modern phenomenon of political capitalism—a term that captures the commodification of influence and power. The recent inquiry launched by House Democrats over the president’s crypto dealings is not merely an act of political opposition; it is a critical moment that compels us to examine the implications of mixing politics with digital currencies.

The Inquiry: A Necessary Scrutinization

The inquiry initiated by prominent House Democrats, including Gerald Connolly, Joseph Morelle, and Jamie Raskin, highlights urgent issues surrounding Trump’s fundraising strategies. Their letter to Treasury Secretary Scott Bessent, which outlines concerns of allegedly illegal fundraising and potential foreign influence, signals a wake-up call. The Democrats are not simply scrutinizing a financial mechanism; they are challenging the integrity of political fundraising itself. By targeting platforms like WinRed and entities such as World Liberty Financial, they’re stressing that political fundraising must operate within the bounds of legal and ethical accountability. This inquiry reveals the complex web of politics and digital currencies—a space that can too easily become a breeding ground for corruption and fraud.

Questionable Practices: World Liberty Financial at the Center

One of the most alarming aspects of this inquiry is the focus on World Liberty Financial (WLF) and its WLFI token sale. Following unfulfilled fundraising targets, WLF’s $75 million investment from Tron founder Justin Sun raises eyebrows. Given Sun’s ongoing entanglements with the SEC, one cannot help but question whether these financial maneuvers are a cover for illicit activities. The sheer scale of profits reaped from meme coins like TRUMP and MELANIA further complicates the narrative. With entities close to Trump controlling 80% of the former’s supply and making staggering gains, it begs the question: are these transactions a manipulation of market trust, or a legitimate investment opportunity? Such patterns fuel skepticism and accusations of insider trading and pump-and-dump practices, precisely the kind of activities that should concern any responsible legislator.

The Shadow of Foreign Influence

Far more sinister are the implications of foreign investment in Trump’s crypto ventures. The potential for foreign actors, particularly from nations like China, to gain political leverage through anonymous coin purchases poses grave national security concerns. This situation reflects a broader anxiety surrounding foreign influence in American politics. If anonymous crypto transactions allow foreign nationals to prosper at the expense of average American investors—many of whom have lost substantial sums—then democracy itself is at risk. The inquiry rightly highlights this aspect, urging transparency and accountability in a financial arena that thrives on anonymity.

Combining Business and Politics: A Dangerous Precedent

As the investigation unfolds, the connections drawn between Trump’s crypto dealings and his presidential actions reveal a dangerous precedent. The announcement of plans to launch a stablecoin, USD1, and subsequent backing by an Abu Dhabi fund further intertwine business interests with political power. The ethics of this mingling cannot be ignored, particularly when past dealings have raised serious concerns over compliance with U.S. regulations. Politicians should operate with an ethical compass that prioritizes national interests above personal gains; anything less diminishes the integrity of political office and public trust.

The Need for Regulation: A Call to Action

Amid concerns of rampant unregulated activity, the inquiry serves as a rallying point for those advocating for stronger oversight in the political landscape of crypto. The introduction of bills aimed at restricting elected officials from profiting from meme coins and stablecoins is a step in the right direction. Echoing the sentiments of Representatives like Ritchie Torres and Senators Elizabeth Warren and Adam Schiff, it becomes evident that the legislative framework surrounding political involvement in crypto needs significant reinvigoration. With the GENIUS Act being voted down, it raises a fundamental question: will Congress rise to the occasion, or will apathy allow the situation to spiral out of control?

In an era where digital currencies hold tremendous potential, it’s crucial to ensure that they don’t become tools for misuse and corruption by those in power. The scrutiny of Trump’s crypto ventures may be a foundation for necessary changes that ensure accountability at every level of political fundraising and engagement. As this inquiry unfolds, it will be a litmus test for not just the Trump administration, but for the ethics of future political actors and their ventures into the new financial frontier.