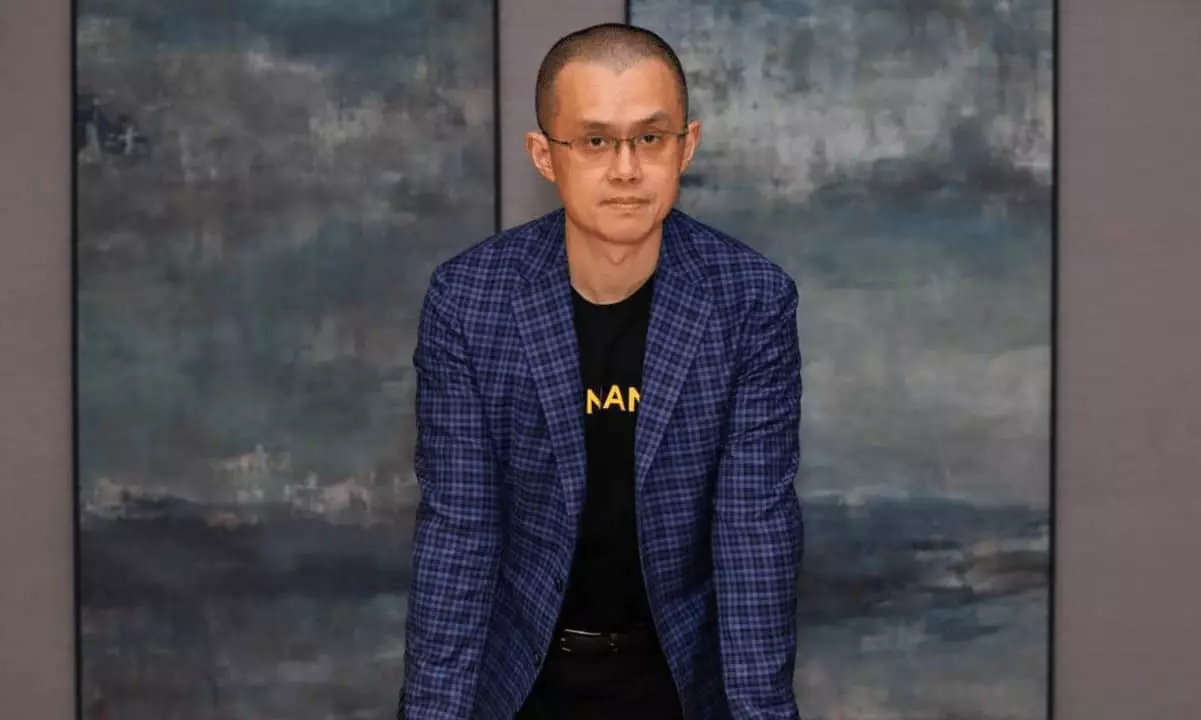

Changpeng Zhao (CZ), founder of Binance, is stirring the waters of the cryptocurrency world by advocating for a “will function” across all digital asset platforms. This idea isn’t just innovative; it’s necessary. As cryptocurrency ownership expands, so does the responsibility that comes with it. Inheritance issues can be a minefield, particularly when individuals pass away without disclosing their assets to loved ones. In essence, CZ’s proposal underlines a fundamental truth: the digital realm cannot ignore the realities of human mortality.

The statistics are startling. Over $1 billion worth of cryptocurrency is locked away in centralized exchanges every year, relegated to oblivion because users neglect to inform their families about their digital assets. This highlights an urgent need for mechanisms that make these assets accessible to heirs. It’s hard to argue against the necessity of a function that could alleviate the financial distress faced by countless families. Why should users leave behind a legacy of lost money because they didn’t set up simple inheritance pathways?

Empowering Minors and Future Generations

CZ’s additional call for regulators to allow minors to hold crypto accounts is equally significant. Enabling children to receive digital assets but withholding trading capabilities presents a balanced approach to teaching financial literacy and responsibility from a young age. The world is increasingly digitized, and as parents transfer digital wealth, they should have the confidence that their children can inherit it, not just in terms of ownership but also in managing those assets.

Historically, financial institutions have been slow to adapt, and this is becoming more evident in crypto. There’s a real opportunity here to transition towards a more modern banking system that respects digital realities while adhering to the values of traditional financial responsibilities.

Binance’s Innovative Approach

In addressing these issues, Binance has shown itself to be a leader by implementing an “emergency contacts and inheritance heir” feature. This forward-thinking initiative allows users to designate emergency contacts who can claim crypto assets if the user becomes inactive or passes away. This proactive measure contrasts sharply with competitors like Coinbase and BitGo, which adhere to more traditional, cumbersome methods of estate planning.

By enabling users to specify heirs and removing barriers, Binance is not only making cryptocurrency more accessible; it is instilling a culture of responsibility. CZ’s insight that every digital asset owner will eventually contemplate their mortality isn’t just philosophical; it’s a business imperative that many exchanges are overlooking.

The Role of Regulators and the Future Landscape

However, regulatory frameworks must catch up to these innovations. Making it easier for minors to access crypto while ensuring parental controls can only be done effectively with regulatory support. The current landscape is stifled by outdated views on what constitutes sound financial practice for younger generations.

While CZ’s calls for regulations to facilitate these changes are commendable, they shouldn’t halt progress. The cryptocurrency community must push not only for regulation but also for a new social contract regarding digital assets. This isn’t merely a technological problem but a societal one, bridging generational gaps and fostering a sense of accountability.

Changpeng Zhao’s advocacy for inheritance functions and broader accessibility for minors in crypto accounts aligns with the core principles of financial inclusivity and social responsibility. As users and regulators navigate this terrain, the future of cryptocurrency hinges more than ever on the human experiences tied to wealth inheritance.