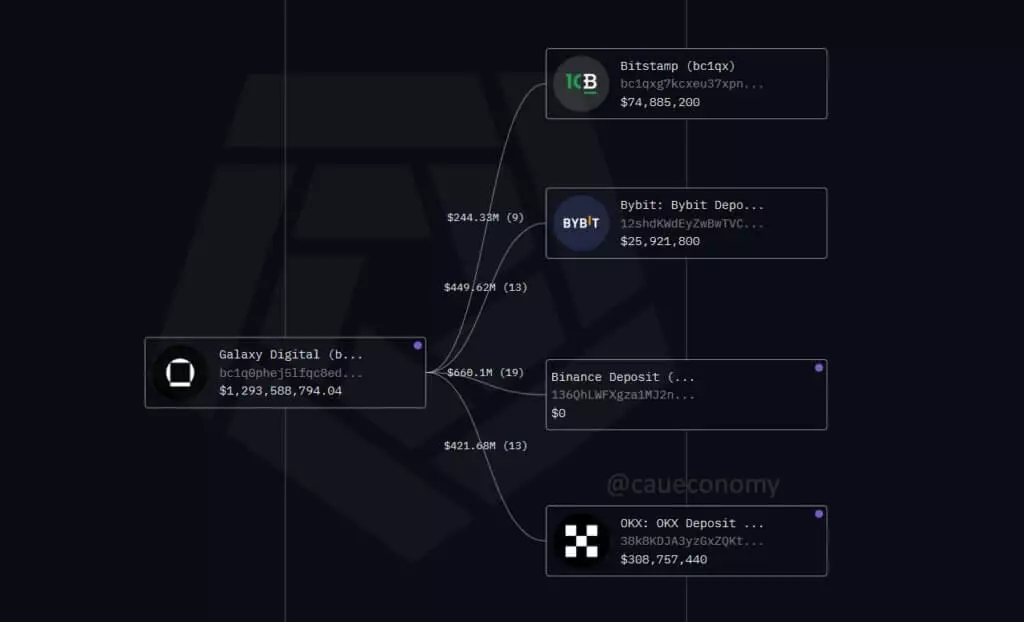

Over the past 24 hours, Galaxy Digital has orchestrated a significant movement of Bitcoin, transferring over 17,000 BTC—equivalent to more than $1.7 billion—to major exchanges such as Binance, OKX, Bybit, and Bitstamp. At face value, this appears as routine institutional activity; however, a deeper analysis reveals a pattern of strategic unwinding that could ripple through the broader crypto landscape. While the company has historically handled assets on behalf of institutional clients, these recent transfers suggest an underlying motive that contrasts sharply with compelling narratives of confidence in Bitcoin’s long-term potential. Instead, they hint at a calculated profit-taking or risk management decision—one that could erode market confidence if it snowballs.

The timing of these transactions is particularly noteworthy. Between July 15 and 17, Galaxy Digital’s Bitcoin holdings surged from roughly $850 million to a staggering $6 billion, driven by consolidations of dormant wallets dating back to 2011. Such accumulation implies institutional strategy oriented towards long-term custody; yet, the subsequent swift transfer of a large portion to exchanges indicates an impending exit rather than a hold. The pattern echoes classic distribution behavior, especially with high-volume deposits like a single 10,000 BTC transfer, teetering on the edge of market destabilization. Despite the company’s silence, market players are left to interpret these signals, fueling speculation that a major distribution phase is underway.

Market Impact and the Flawed Narrative of Institutional Stability

The consequences of this activity are clear. Bitcoin’s price has experienced a 2.5% decline in just 24 hours, sliding around $115,600, amid a trading volume exceeding $94 billion. Such market movements are hardly coincidental—liquidity appears thin, and the sell pressure is mounting. Analysts, including Cauê Oliveira from BlockTrends, warn of a potential downward spiral should more Bitcoin flood onto exchanges from large wallets. The staggered drain of BTC from Galaxy’s holdings, especially when large chunks like 40,000 BTC are transferred to hot wallets, underscores a pattern of distribution rather than simple custodial reallocation. This erodes the presumption of institutional confidence, exposing a vulnerability often masked by illusions of stability.

Moreover, recent on-chain data reveals an unsettling trend: Galaxy’s outgoing Bitcoin is distributed in batches often associated with profit-taking or liquidation. This isn’t a case of strategic asset repositioning; it’s a clear indication of an institution preparing to cash out. The firm still retains a significant stash of over 60,000 BTC, but whether this is a buffer or a hesitating step toward further liquidation remains uncertain—yet the warning signs are unmistakable.

What This Signals for the Broader Crypto Ecosystem

Embedded within these transactions is a sobering lesson—trust in large institutional players like Galaxy Digital should be tempered by caution. Their recent moves suggest a secretive unwind that could signal a shift in institutional sentiment, especially amidst volatile market conditions. As liquidity thins out and sell orders increase, retail investors lack the cushioning typically provided by larger, more stable entities. This scenario exposes a fundamental flaw: the illusion that institutional players always act as stabilizers is dangerously misguided.

Furthermore, by cloaking their true intentions behind layers of on-chain obfuscation, firms like Galaxy Digital deepen market uncertainty. The fact that they have yet to confirm the ultimate destination of the transferred Bitcoin fuels distrust and speculation. If, indeed, this is a strategic offloading—whether for profit, risk reduction, or balancing client portfolios—it marks a turning point that cannot be ignored. Markets are sensitive to large waves of supply, especially when they arrive in small, staggered batches designed to mask true intentions.

Ultimately, this episode underscores an uncomfortable reality: institutional complacency can quickly turn into chaos. As assets are silently moved from custody to exchanges, the threat of a market dump increases. The best investors—those willing to see through the facade—must remain vigilant. The narrative of resilience and growth may be comforting, but beneath it lies a fragile foundation, susceptible to shocks from the actions of a few giants wielding significant influence.