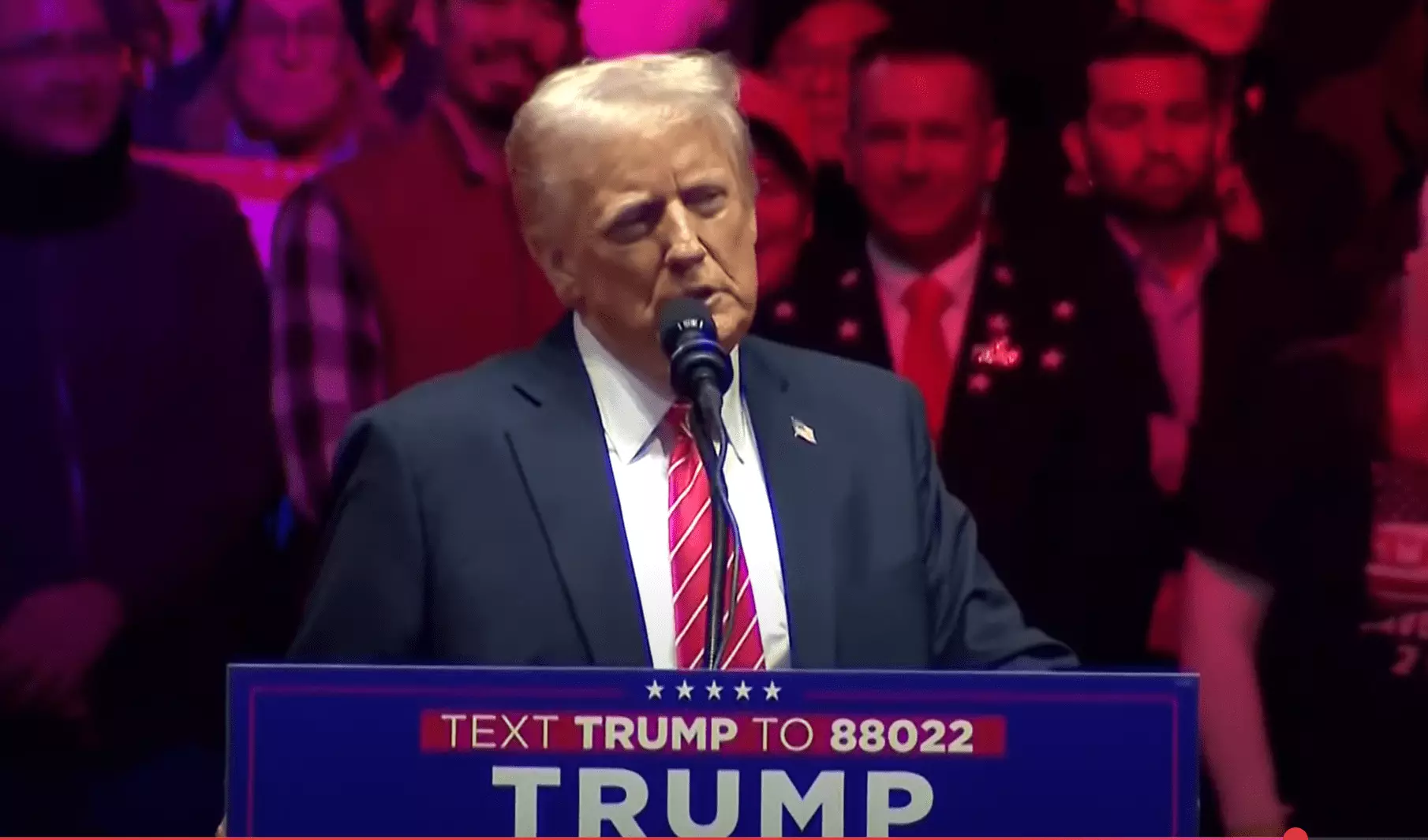

Bitcoin, the pioneering cryptocurrency, has once again captured the world’s attention by surging to a remarkable new high of $109,558, coinciding with significant political developments in the United States. This unprecedented price spike, occurring during the early hours of trading in Asia, raises questions about the influence of political events on cryptocurrency values and the broader implications of these movements. In particular, speculation surrounding the potential establishment of a Strategic Bitcoin Reserve (SBR) by former President Donald Trump has emerged as a primary catalyst for Bitcoin’s latest ascent.

On the day of Trump’s inauguration, discussions about the formation of a U.S. Bitcoin reserve gained momentum. Market analysts noted a marked increase in predictions regarding the likelihood of an SBR being implemented within Trump’s first 100 days in office, as reflected on platforms like Polymarket. This sudden spike in perceived probability—up to 59%—preceded Bitcoin’s dramatic price increase, suggesting a psychological correlation between political developments and market performance. The anticipation of a formalized government position on Bitcoin undoubtedly lit a fire under the cryptocurrency’s value, demonstrating how sensitive the market is to external cues.

Suspicion and speculation regarding Trump’s potential approach towards Bitcoin and cryptocurrencies have been brewing for months. Notably, during his campaign, Trump hinted at the possibility of transitioning seized Bitcoins from law enforcement into a government reserve, which would represent a significant shift in how digital currencies are perceived and regulated. The notion that a formal executive order could come as soon as inauguration day has only amplified this speculative fervor, as investors rush to capitalize on anticipated changes in policy.

Meetings between influential Bitcoin advocates and Trump’s administration also contributed to the momentum driving Bitcoin prices. Prominent figures within the cryptocurrency community, including Senator Cynthia Lummis and Michael Saylor, actively engaged with the incoming administration, showcasing a united front in favor of Bitcoin advocacy. Lummis, known for her strong pro-Bitcoin stance, has made it a priority to push for the enactment of a Strategic Bitcoin Reserve. Her legislative proposals, colloquially known as the “Bitcoin Bill,” aim to facilitate the purchase of a million Bitcoins, an endeavor that could have staggering implications for the market.

Saylor, Chairman of MicroStrategy, attended crucial meetings with key members of Trump’s cabinet, signaling the tech and investment community’s increased involvement in executive discussions regarding digital assets. Their presence reinforces the idea that major moves are afoot in terms of Bitcoin policy, and such high-level engagement with the administration typically fosters a more favorable regulatory environment for crypto assets.

Looking at the market’s reaction to these developments, analysts such as Charles Edwards from Capriole Investments pointed out a noteworthy trend: Bitcoin’s rapid price fluctuations from highs to lows, and then back to record peaks, imply that the potential for growth remains robust. Edwards’ observation, emphasizing the significance of the “second move” in financial trends, indicates that this latest rally could be more than a fleeting moment of speculation. The collective optimism surrounding a potential strategic reserve not only energizes the current investor base but may also attract new participants to the cryptocurrency market, particularly individuals aligned with Trump’s political ideology.

The enthusiastic reception from influential figures within both the Bitcoin community and the Trump administration signals an uncommon convergence of interests, potentially paving the way for the U.S. to emerge as a pivotal player in the global cryptocurrency arena. If the SBR is formalized, it could signal a major turning point in how digital currencies are integrated into governmental practices and the financial system at large.

As Bitcoin enters this uncharted territory, marked by a combination of speculative excitement and potential regulatory shifts, investors must remain acutely aware of the volatility inherent in the market. The excitement generated by political developments is often tempered by the unpredictability of governmental decision-making and market sentiment. While the prospect of a Strategic Bitcoin Reserve is thrilling for many, the realities of market corrections and operational complexities mean that caution remains essential.

Bitcoin’s recent rally, intertwined with the political narrative surrounding Trump’s administration, emphasizes the delicate interplay between cryptocurrency and governance. As events unfold, the implications for Bitcoin’s future will likely extend beyond speculative trading into significant financial policy shifts that could redefine the relationship between government and digital assets. Investors need to keep their finger on the pulse of both market dynamics and political sentiments to navigate this evolving landscape effectively.