The legal showdown between the Securities and Exchange Commission (SEC) and Ripple Labs continues to make headlines as the SEC announces its intent to appeal a recent federal court ruling. This conflict, which began in December 2020 when the SEC accused Ripple of engaging in an unregistered securities offering valued at $1.3 billion through the sale of its digital currency, XRP, has developed into a landmark case that weighs heavily on the cryptosphere. As the SEC pursues its appeal, the outcomes of this case could reshape regulatory expectations and the future of cryptocurrency businesses in the United States.

The saga took a pivotal turn in August when US District Judge Analisa Torres issued a mixed ruling regarding the status of XRP. While she maintained that Ripple’s programmatic sales of XRP to retail investors via cryptocurrency exchanges did not constitute a violation of securities laws, she also determined that the company’s direct sales to institutional investors—totaling approximately $728 million—qualified as unregistered securities transactions. This led to Ripple facing a $125 million penalty, which, although significantly less than the $2 billion originally sought by the SEC, remains a point of concern.

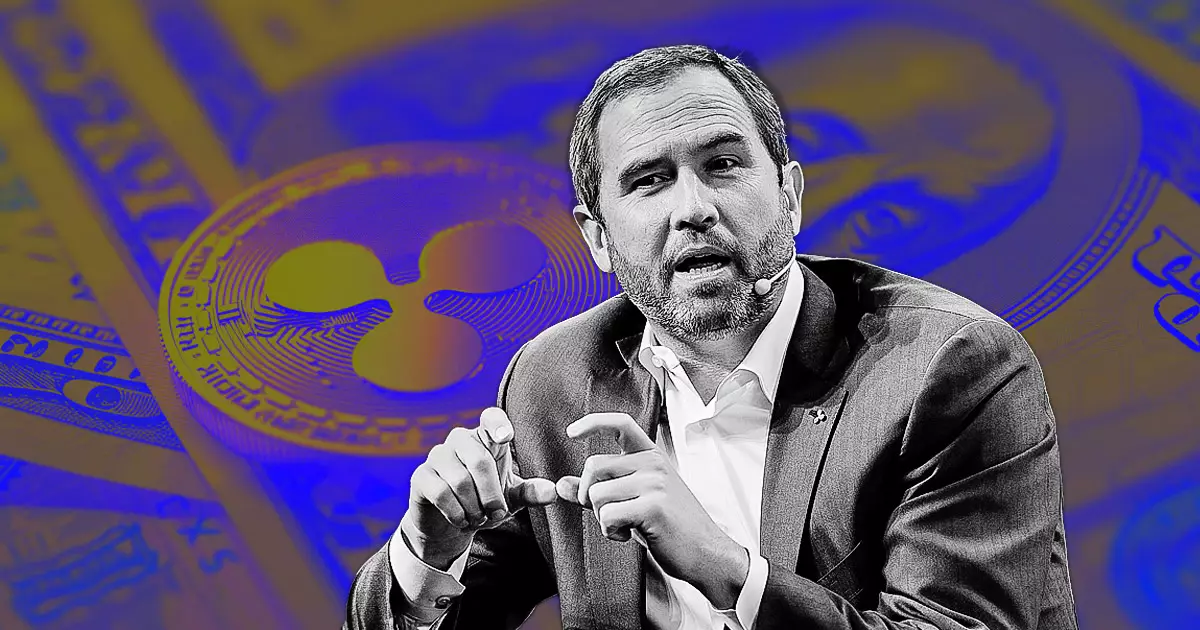

For Ripple, this mixed outcome was celebrated as a partial victory, especially in the context of the broader implications for the cryptocurrency sector, which has been subjected to increasing scrutiny from regulators. Ripple executives, including CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty, expressed their disdain over the SEC’s decision to challenge the ruling, emphasizing their commitment to defend the case vigorously. They argue that the agency’s persistence not only wastes taxpayer resources but also clings to an outdated and ineffective regulatory paradigm.

In reaction to the SEC’s decision to appeal, the price of XRP has faced volatility, reflecting the uncertainty that now marks Ripple’s standing in the market. At one point, XRP’s value plummeted by approximately 9%, showcasing the immediate impact of regulatory news on cryptocurrency prices. Despite this downturn, XRP maintains its status as one of the leading cryptocurrencies, ranked seventh by market capitalization.

Ripple’s executives have voiced their frustration with the SEC, asserting that the agency appears indifferent to the legal implications of its actions. Garlinghouse has accused the SEC of losing on all fronts that matter—including the argument of whether XRP should be classified as a security. The tension between the two entities sheds light on broader regulatory challenges faced by the crypto industry, highlighting the urgent need for a clearer legal framework.

As the appeal unfolds, Ripple is evaluating its strategic options, including the potential for a cross-appeal. This indicates a readiness on the part of Ripple to contest the parts of the ruling that were not favorable to the company, particularly the ruling concerning institutional sales of XRP. In the broader context, this case raises crucial questions about regulatory practices and the legal status of cryptocurrencies, which remain ambiguous in many respects.

Moreover, the sentiments of Ripple’s leadership resonate with a growing chorus within the crypto industry advocating for a legal framework that accommodates innovation while ensuring investor protection. They argue that the SEC’s response to the rapid evolution of digital assets is a form of litigation warfare, one that ultimately stifles growth and discourages future investments in a technology that could revolutionize finance.

As we move deeper into this legal battle, the outcomes of Ripple’s appeal and the SEC’s actions could set precedents that define the relationship between cryptocurrency companies and regulatory bodies. Investors, technologists, and legal experts are closely monitoring this case, as its resolution will likely impact not just Ripple, but the entire digital asset ecosystem.

The ongoing litigation between the SEC and Ripple Labs is not just a contentious case confined to a courtroom; it embodies the tensions between innovation and regulatory oversight in a rapidly evolving financial landscape. The decisions made in this ongoing dispute will have reverberations throughout the cryptocurrency sector, making it essential for industry participants to remain vigilant and informed as they navigate the realities of operating within a complex regulatory environment.