The recent flurry of news surrounding tokens like MegaETH, Giggle Fund, and SynFutures exemplifies a recurring pattern in the cryptocurrency landscape: an obsession with rapid gains and immediate validation. Often, investors and project founders alike fall prey to the allure of quick profits, mistaking hype for sustainability. This shortsightedness not only skews market perceptions but also cultivates an environment where projects launch with fanfare—such as aggressive airdrops or listings—yet lack genuine long-term utility. The truth, however, is that the crypto market’s intrinsic volatility demands a sober, pragmatic approach. Relying on shortcuts like airdrops or fleeting exchange listings can create superficial boom periods, but they rarely build resilient ecosystems. It’s an illusion of stability that ultimately erodes trust among serious investors who seek substance over spectacle.

The Mirage of Short-Term Growth as a Marker of Legitimacy

In recent days, headlines about Binance listing new tokens and the anticipation of exponential valuation—like Bitcoin reaching $112,000 against Ethereum’s $4,200—fuel an insatiable appetite for market movement. These stories tend to eclipse the necessity for fundamental analysis, turning attention instead to sensational figures. Investors are enticed by the promise of quick riches, often overlooking the importance of underlying technology, adoption, or regulatory frameworks critical for long-term success. Meanwhile, the fragmentation of projects across various sectors—NFTs, DeFi, stablecoins—makes clear that many developments are driven by hype cycles rather than tangible utility. As a center-right liberal observer, I argue that this pattern risks prioritizing short-term profits over the social and economic stability necessary for crypto to mature into a reliable asset class.

Are We Overestimating the Impact of Short-Term Announcements?

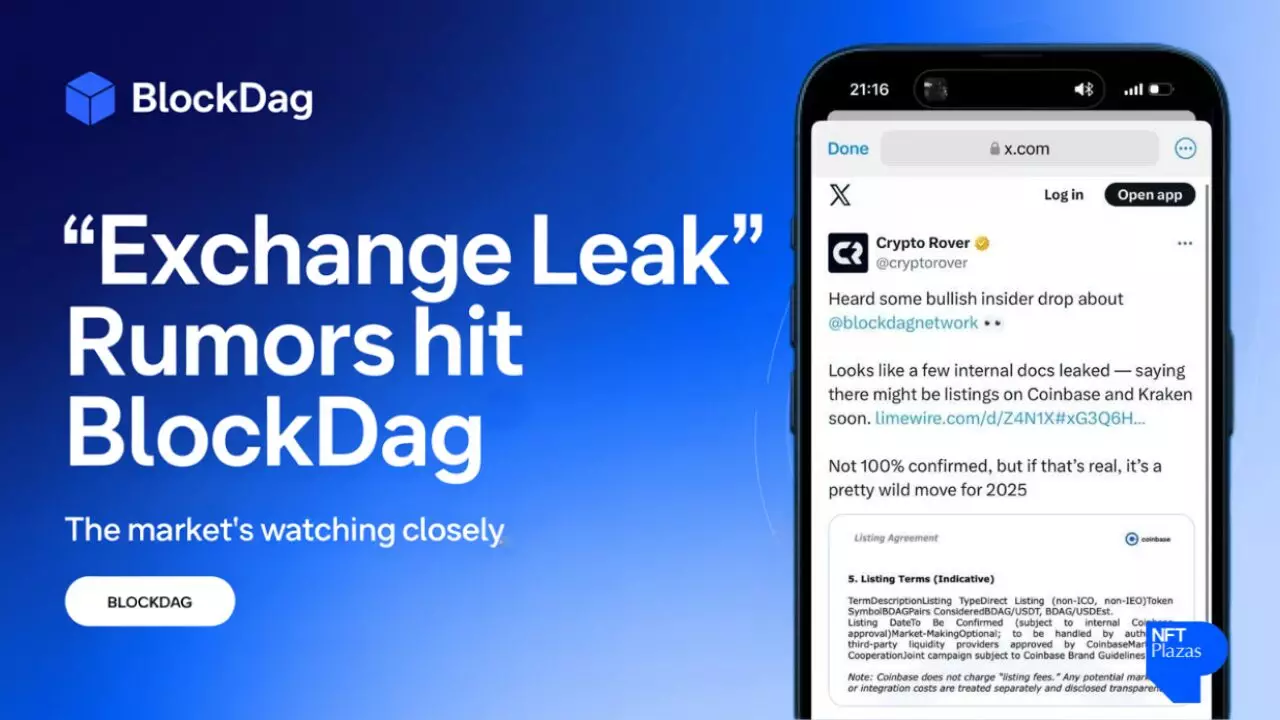

The recent announcements about upcoming token sales, airdrops, or platform acquisitions—such as MQTT’s new infrastructure or NFT stats platforms—pose questions about real value creation. Countless projects announce ambitious plans to become the “next big thing,” but far fewer actually deliver. It’s easy to get caught up in the excitement of token burns, airdrops, or celebrity endorsements, but these are often smokescreen tactics that conceal the lack of sustainable growth strategies. A responsible approach would see a focus on regulatory compliance, interoperability, and clear utility—elements that are often overshadowed by crowdfunded hype campaigns. For the crypto ecosystem to gain legitimacy beyond speculative trading, stakeholders must look beyond superficial narratives and demand accountability, transparency, and real-world integration.

The Danger of Echo Chamber Mentality and Herd Mentality

The crypto space, by its very nature, fosters communities prone to herd behavior. When projects like 2WINZ or TURTLE promise lucrative airdrops, the primary driver becomes FOMO—fear of missing out—rather than informed decision-making. This phenomenon skews market signals, causing bubbles driven by collective greed rather than rational valuation. In a centrist-liberal view, it’s crucial that the industry promotes education, critical thinking, and responsible investing. The danger lies not just in individual losses, but in the potential for systemic destabilization, especially if regulatory authorities decide to clamp down on speculative excesses or fraudulent schemes. Sustainable growth in crypto must be rooted in innovation that addresses real societal needs, rather than merely riding waves of hype.

The Need for a Balanced Perspective in Crypto Evolution

Despite the shortcomings, the sector is undeniably evolving, with promising projects like Enso’s intent engine or Monad’s solution to blockchain scalability hinting at a future where crypto could serve more meaningful purposes. Yet, these innovations require genuine support and patience, not impulsive trading or hype-driven narratives. The current environment often overemphasizes immediate gains, ignoring the practicality and stabilization that conservative, center-right policies can promote. Encouraging responsible innovation—where projects are evaluated on utility, security, and compliance—will be essential for crypto’s transition from speculative “wild west” to a trustworthy pillar of modern finance. The industry must embrace a sober outlook, rejecting empty promises in favor of substantive progress that can withstand regulatory scrutiny and market volatility alike.