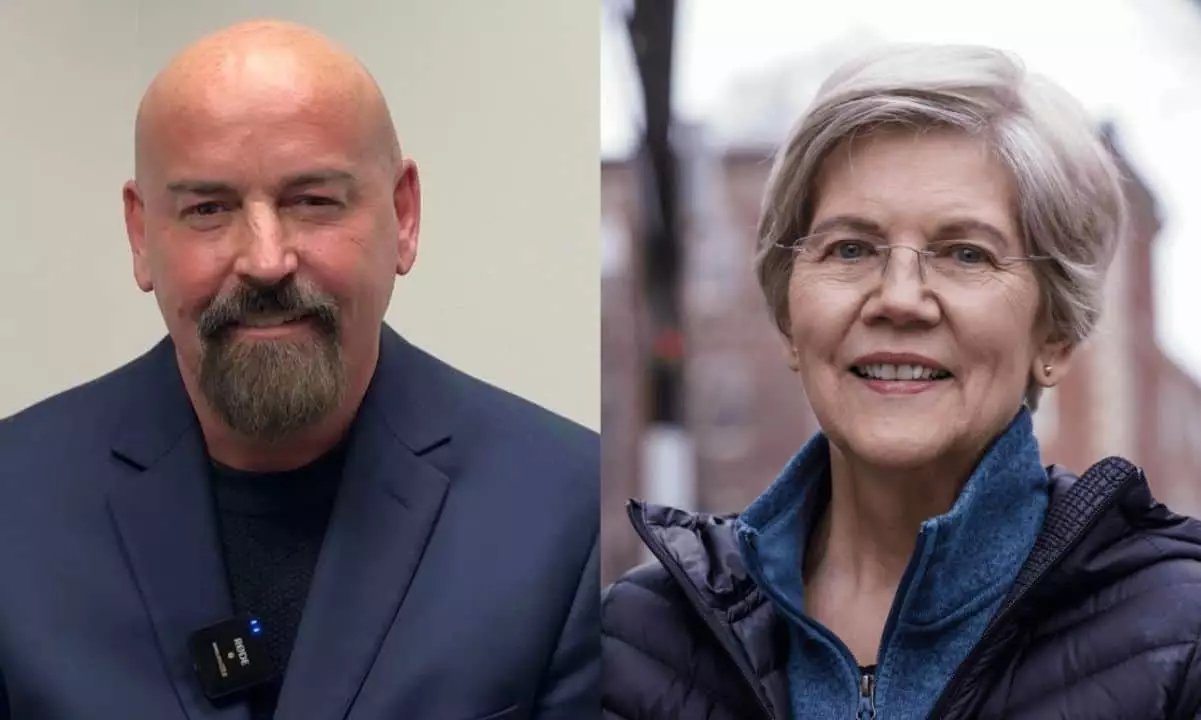

The recent debate between Massachusetts Senator Elizabeth Warren and her pro-cryptocurrency challenger, John Deaton, highlighted the stark ideological divide between traditional financial regulation and the burgeoning digital asset space. As the dialogue unfolded, it became evident that both candidates not only represented distinct viewpoints on cryptocurrency but also different approaches to legislative priorities in an increasingly digital economy.

One of the debate’s most striking moments came when Senator Warren accused Deaton of potentially becoming a puppet for the cryptocurrency industry, prioritizing the interests of wealthy investors over those of average voters. This accusation serves to illustrate a broader concern often voiced by critics of the crypto world: that the sector is predominantly driven by profit motives that neglect consumer protections. Warren’s statement raised a question about the integrity of representatives in a system where campaign financing can intertwine with regulatory decisions.

Conversely, Deaton firmly rebutted Warren’s insinuations, suggesting that her focus on crypto diverts attention from pressing issues such as inflation and the rising cost of living. By recounting a personal experience—how cryptocurrency provided his financially struggling mother with a way to avoid oppressive banking fees—Deaton positioned himself as an advocate for everyday individuals who might otherwise feel marginalized by established financial systems. This personal storytelling technique is effective not just in engaging the audience but in humanizing a debate often filled with abstract arguments.

The crux of the discourse raised larger questions about the role that cryptocurrency should play in society. For Warren, crypto represents significant risks that threaten not only consumers but the integrity of the American financial system as a whole. She articulated concerns about the potential for digital assets to facilitate illicit activities, such as money laundering and terrorist financing. Her stance reflects a fundamental belief in the need for regulation to protect consumers from volatile assets and unscrupulous actors within the crypto market.

On the flip side, Deaton contends that the existing financial landscape fails to adequately serve large segments of the population, particularly those restricted by traditional banking systems. He argues that by pushing for stringent regulations, Warren inadvertently aligns herself with the interests of large banks and financial institutions, which could stifle innovation and access for those who might benefit from decentralized financial options. Deaton’s argument taps into a significant narrative in the crypto community: that blockchain technologies and digital currencies may provide avenues for financial independence and resilience.

Both candidates recognize the need for regulation but differ drastically in their vision of what that regulation should encompass. Warren’s advocacy for stricter rules on digital assets aligns with her description of building an “anti-crypto army,” reflecting a belief that unchecked innovation could lead to widespread financial peril. However, Deaton retorts that such regulations often favor entrenched financial institutions over the very individuals they purport to protect. This ongoing struggle between regulation and innovation highlights the complexities of crafting policies that respond effectively to a rapidly changing economic landscape.

Furthermore, Deaton’s reference to his work on the Ripple v. SEC case underscores a pivotal point: the tension between regulatory bodies and the entities they seek to regulate. This case symbolizes the battle for the future of digital assets in the United States, where definitions of ownership and custody are hotly debated.

The Warren vs. Deaton debate serves as a vital reflection of the challenges faced in the intersection of traditional finance and digital innovation. As technological advancements continue to reshape economic possibilities, discussions around cryptocurrency will only grow more prevalent. The stark divergence in perspectives offers a critical understanding of the potential implications for both the individual consumer and the broader financial system.

Ultimately, what this debate encapsulates is more than mere political disagreement; it embodies a societal crossroads where technology, regulation, and personal finance converge. As voters and citizens, it is imperative to engage actively with these discussions, considering the intricate balance between innovation’s promise and the need for robust consumer protections in an evolving landscape.