The latest surge of Ethereum, pushing its price to a temporary high around $2,740, has created ripples of excitement throughout the cryptocurrency community. However, as we dive deeper into this price fluctuation, it becomes apparent that what seems like a moment of triumph may actually portend deeper challenges that investors must confront. The euphoria surrounding Ethereum’s recent gains, while palpable, is mixed with a heavy dose of caution, as many analysts believe that the prevailing conditions might set the stage for a precarious descent rather than a sustained ascent.

First and foremost, Ethereum has achieved a remarkable performance, eclipsing 50% in gains since the previous week. But let’s not be fooled by surface-level optimism; this surge came after an extended period of significant downturns. Reflecting on historical trends in the crypto market, we can observe that such rapid rises are typically followed by analogous declines. The apparent bullish momentum we see now could very well just be a deceptive mirage, drawing in unsuspecting investors who fail to acknowledge the constant volatility that defines the cryptocurrency landscape.

The Importance of a Support System

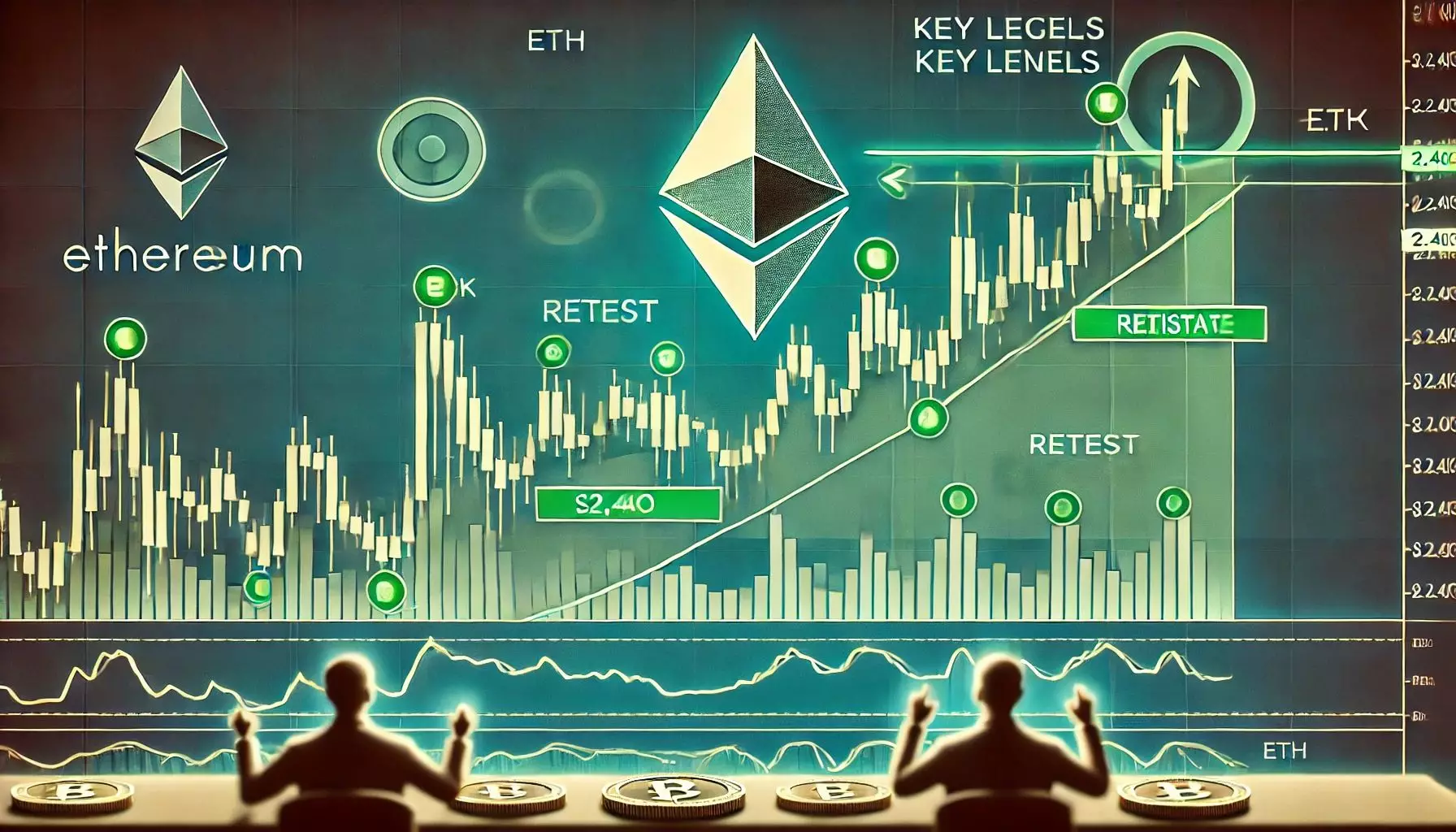

Central to the conversation regarding Ethereum’s next moves is the $2,400 support level, touted by various market analysts as a crucial pivot point. This level isn’t just a number; it represents a lifeline for Ethereum as it attempts to clarify its direction in the coming days. The concern here is straightforward: if Ethereum cannot maintain its footing above this critical support, it may precipitate a harsher corrective phase that could undermine the recent bullish sentiment.

Analyst Daan has rightly pointed out the excessive levels of Open Interest in the ETH derivatives market as a warning sign. It begs the question: are there hidden vulnerabilities lurking beneath this surface excitement? By avoiding long positions until this leverage dissipates, Daan emphasizes the cautious approach that seems prudent considering the current climate. Fighting against the alluring promise of higher gains might be the smarter play for individuals who understand the psychological nuances of trading—especially in a market that thrives on speculation.

Defining Market Sentiments and Resistance

While many are quick to jump on the Ethereum bandwagon, we need to heed the signs of market indecision. Currently, Ethereum is trading under the 200-day Simple Moving Average (SMA) and facing a bottleneck in its attempts for a breakout. With the recent volatility creating an environment ripe for speculation, it is essential for traders to approach Ethereum’s price actions with a level of skepticism. Just because we have witnessed strong buying pressure does not mean we should disregard the looming risk of downturns.

This resistance at the 200-day SMA signals a barrier that Ethereum must breach convincingly to regain traction. The fluctuating volume accompanying this price action is reflective of market indecision. While bulls strive to keep their gains intact, they must be mindful of rallying against a wall of uncertainty. Even a simple failure to push past critical resistance could unravel the considerable progress made in recent days.

The Realities of Altseason

As Ethereum reaches for stars like $3,000–$3,100, many investors dream of what has been termed an “altseason,” a period when altcoins follow Ethereum’s upward trajectory. While on one hand, the prospect of trending into an altcoin bonanza is enticing, one must remain aware of historical precedents that tell a different story. Past patterns reveal that altcoins often suffer lingering frustrations, with many lagging well behind Ethereum’s key performances in prior cycles.

Should Ethereum falter at key support levels, it could drag down the altcoin market with it. The optimism surrounding an altseason hinges precariously on Ethereum maintaining strong momentum, something that feels increasingly tenuous. Thus, potential investors must question whether hopping on the Ethereum train now might result in being left stranded at the next station, watching as those with sharper insights capitalize on more stable opportunities in the market.

Consolidation vs. Correction: The Dilemma

In examining recent price movements, it becomes clear that Ethereum is at a crossroads. The potential for a healthy consolidation phase is evident; however, the lingering threat of a deep pullback gives way to anxiety about sharp corrections. With continued trading between $2,400 and $2,700, Ethereum may have the chance to establish a base, but this could also draw out indecision that often leads to rash decisions driven by fear—highlighted by those still smarting from recent market losses.

Investors should embrace a mindset of patience over fervent excitement. It may be wise to respect the market’s historical unpredictability and focus on developing a keen understanding of Ethereum’s structural strengths and weaknesses. In this trade-off between successful navigation and reckless abandon, one fundamental reality remains: in the unpredictable world of cryptocurrency, sometimes less is more, and prudence may bear the most significant returns.