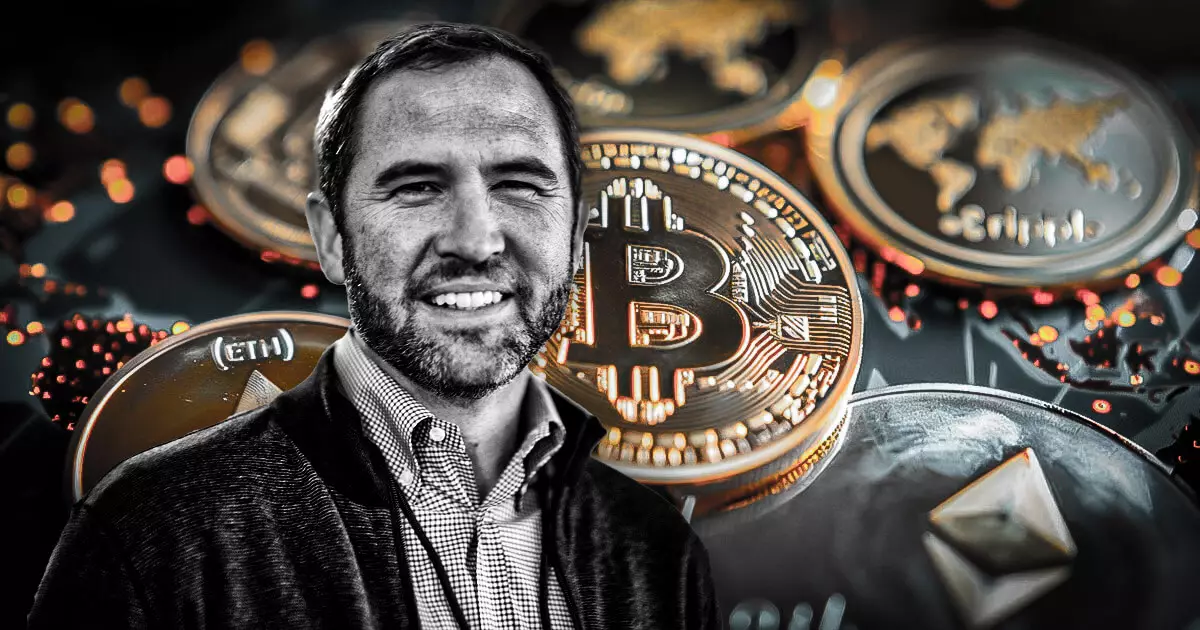

In the ever-evolving landscape of cryptocurrency, the insights from Ripple CEO Brad Garlinghouse serve as a beacon of optimism regarding regulatory advancements in the United States. His recent engagement with prominent lawmakers indicates a notable shift in the dialogue surrounding digital assets. During a visit to Washington, D.C., Garlinghouse met key figures including Senators Tim Scott and Chuck Schumer as well as Representatives French Hill, Ritchie Torres, and Bill Huizenga. This kind of high-profile dialogue is crucial, as it underscores a growing willingness among legislators to discuss and possibly embrace regulations that could foster innovation in the cryptocurrency space.

Potential for Bipartisan Support

Garlinghouse’s experiences point to a potential for bipartisan support in fostering a comprehensive regulatory framework for digital currencies. This rare common ground among politicians represents a crucial moment for cryptocurrency stakeholders who have been advocating for clear and balanced regulations. The CEO characterized the discussions as encouraging, suggesting that lawmakers are beginning to recognize the balance between promoting innovation and maintaining market stability. This evolving sentiment across the legislative landscape could herald a new phase for the cryptocurrency sector, one where the emphasis is on collaboration rather than restriction.

Momentum for legislative clarity is palpable, with notable efforts already underway. The House of Representatives is currently advancing the STABLE Act, aimed at improving transparency and accountability within the stablecoin segment of the market. In parallel, the Senate is deliberating on the GENIUS Act, which seeks to establish a framework for U.S. stablecoins that includes licensing requirements, risk management protocols, and asset reserve mandates for issuers. However, amid these hopeful developments, the trajectory of these legislative initiatives remains uncertain, embodying the inherent challenges faced by innovators in navigating a complex regulatory environment.

In tandem with legislative action, U.S. regulatory bodies are also exhibiting a proactive approach to cultivating a conducive environment for cryptocurrency growth. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are each striving to balance the dual imperatives of economic advancement and market integrity. The appointments of individuals supportive of the crypto industry to lead these agencies signal a potential alignment of regulatory frameworks with the needs of digital asset stakeholders. Notable appointments include former Commissioner Paul Atkins to the SEC and Brian Quintenz to the CFTC. Their expertise could be instrumental in shaping a balanced, growth-oriented regulatory landscape.

As the dialogue between lawmakers and industry leaders continues to evolve, the future of cryptocurrency regulations in the U.S. remains an unfolding narrative. While there are precautions and hurdles that necessitate careful navigation, the growing momentum for a defined regulatory environment offers promise. The collective efforts of stakeholders and lawmakers to shape the future of cryptocurrency regulation will likely have lasting implications on the sector’s ability to thrive under an enhanced regulatory framework, encouraging investment and innovation in this dynamic market. Ultimately, the ability to strike a compromise between oversight and freedom could set a precedent for how digital assets are managed in the coming years, leading to greater acceptance and integration of blockchain-based technologies in mainstream finance.