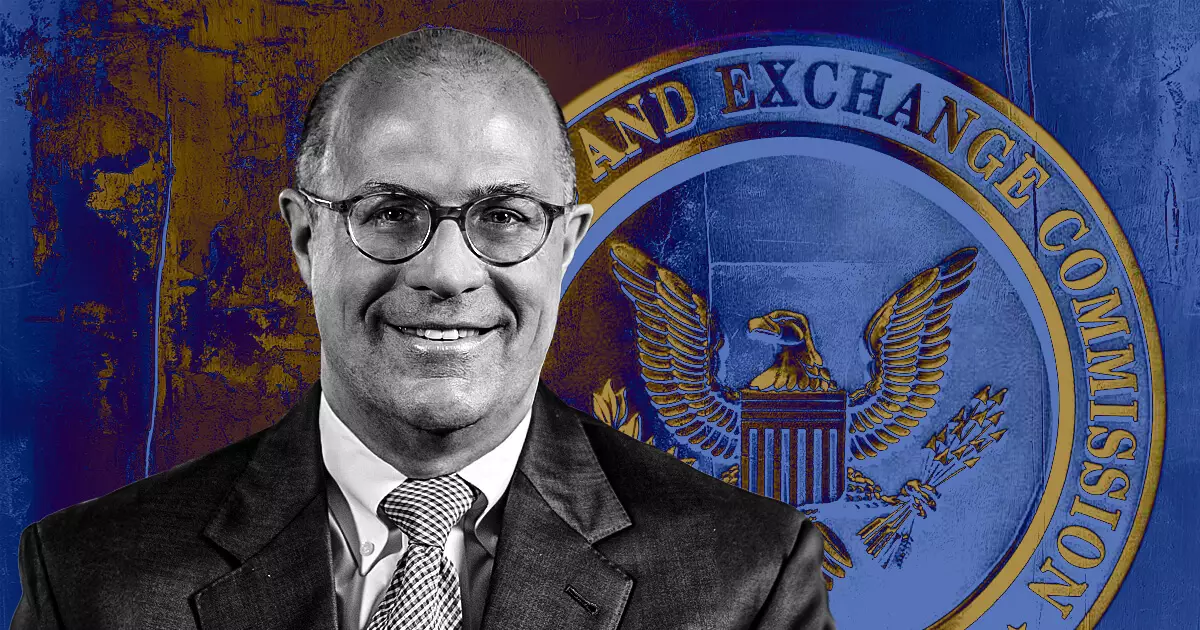

In a recent statement, Christopher Giancarlo, the former Chair of the Commodity Futures Trading Commission (CFTC), firmly dismissed rampant speculation regarding his potential appointment as the next Chair of the US Securities and Exchange Commission (SEC). He has also expressed no interest in taking on a role related to cryptocurrencies within the Treasury Department, underscoring his intent to steer clear of further complications in regulatory matters.

Giancarlo’s comments allude to what he refers to as a “mess” left by the current SEC leadership, particularly criticizing the prevailing “regulation by enforcement” strategy. His mention of a mess hints at ongoing tensions between regulatory bodies and the evolving cryptocurrency landscape, which has become a focal point of contention in recent years.

Taking over as CFTC chair in August 2017, Giancarlo’s leadership style and viewpoints differed markedly from those of current SEC Chair Gary Gensler. While Giancarlo earned the affectionate nickname “Crypto Dad” due to his forward-looking approach towards cryptocurrencies, Gensler has adopted a more cautious and stringent regulatory framework. Giancarlo’s declarations back in 2018, asserting that “cryptocurrencies are here to stay,” starkly contrast with Gensler’s current scrutiny of various digital assets. This divergence highlights the differing philosophies that animate their respective approaches toward digital currencies.

Giancarlo’s tenure saw a more collaborative engagement with the crypto industry, positioning him as a proponent for innovation. In contrast, Gensler’s leadership has sparked criticisms from industry insiders and outsiders alike, revealing frustrations over the SEC’s regulatory path that many view as ambiguous and punitive rather than constructive.

Gensler’s recent speech at the Practising Law Institute’s conference encapsulated his belief that while Bitcoin does not classify as a security, numerous alternative digital assets do fall under existing securities laws. This assertion reinforces his commitment to managing the complexities of the crypto landscape by insisting that issuers and intermediaries adhere to registration requirements. While Gensler insists this approach safeguards investors, it has simultaneously raised concerns within the very industry it seeks to regulate.

Criticism has been levied against Gensler for the SEC’s barrage of lawsuits against leading crypto exchanges like Kraken and Binance. Observers have accused the SEC of prioritizing enforcement actions over creating a clear regulatory framework—an oversight that many argue creates a precarious environment for innovation and investment within the space.

Looking Ahead: Regulatory Clarity Needed

As the cryptocurrency market matures, the call for clearer regulations becomes increasingly imperative. Giancarlo’s reflections on the current state of the SEC and its aggressive posture toward enforcement suggest a need for reconciliatory strategies that embrace innovation rather than stifle it. The divergent visions of Giancarlo and Gensler could serve as a critical backdrop for future discussions on how best to harmonize regulatory interests with industry growth.

The ongoing debate surrounding cryptocurrency regulation reflects the broader struggle of policymakers to balance innovation with consumer protection. As figures like Giancarlo step back from potential leadership roles in this space, the spotlight remains firmly on the SEC and its strategies moving forward. Clarity, cooperation, and a commitment to fostering growth in this burgeoning ecosystem will be essential to its success in the coming years.