In a bold move that has sent ripples through the cryptocurrency community, Gemini has announced it will no longer hire graduates or interns from the Massachusetts Institute of Technology (MIT). This decision arises from MIT’s recent reaffiliation with Gary Gensler, the former Chair of the U.S. Securities and Exchange Commission (SEC), whose tenure was marked by stringent regulations on the burgeoning cryptocurrency sector. Tyler Winklevoss, one of Gemini’s co-founders, made this declaration on social media, signaling a significant stance against what he perceives as MIT’s misguided choices.

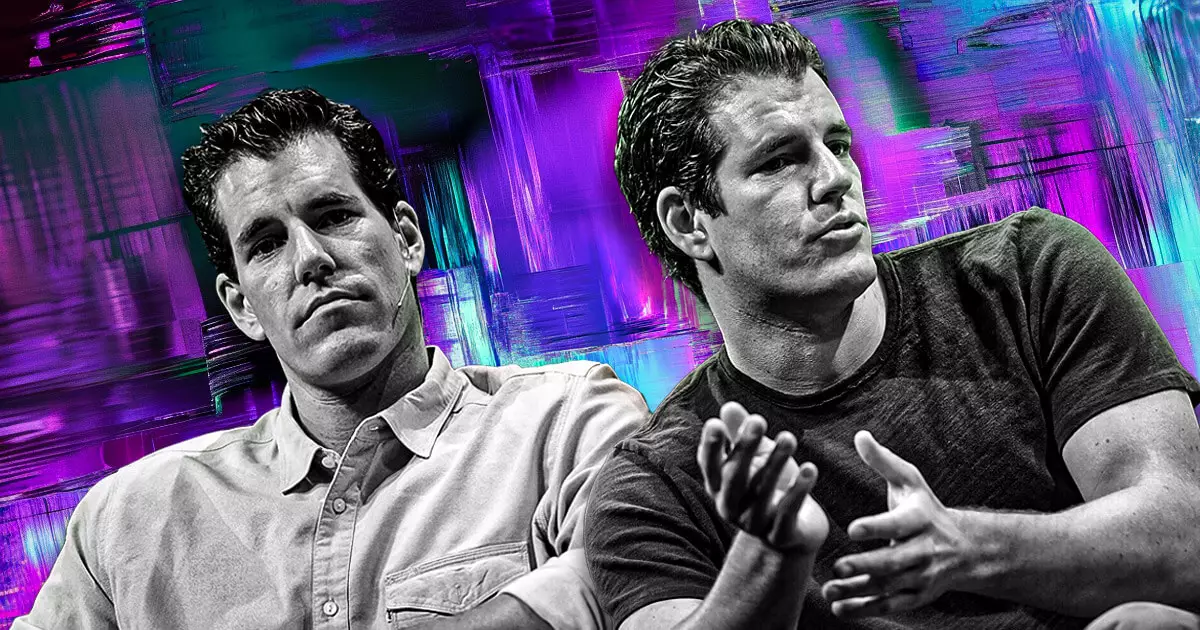

Tyler Winklevoss articulated his concerns with clarity, stating that as long as MIT maintains any ties to Gensler, no candidates from the institution will be considered for employment by Gemini. His comments were supported by his twin brother, Cameron Winklevoss, who described Gensler as a “leading expert on public policy failures.” This indicates a deep-rooted frustration within Gemini about the effects of regulatory policies on innovation in the cryptocurrency sphere. The Winklevoss twins’ condemnation reflects a broader sentiment prevalent among crypto enthusiasts who fear that stringent regulations could stifle technological advancements.

The crypto industry has begun to respond to this latest development. Not only is Gemini distancing itself from MIT, but other prominent figures within the sector have also voiced concerns about Gensler’s influence, particularly given the current climate surrounding digital assets. Paradigm co-founder Matt Huang encouraged MIT alumni working in crypto to engage in dialogue regarding this contentious issue, possibly hinting at more coordinated actions against the institution’s affiliations.

Moreover, Caitlin Long, the CEO of Custodia Bank, raised an important question: Could this signify a larger trend in the industry, where firms actively distance themselves from universities that welcome former regulators viewed as antagonistic to innovation? Long’s statement points to a potential shift in relationships between the cryptocurrency sector and academic institutions that are perceived to be harboring individuals responsible for stringent regulatory practices.

MIT’s decision to rehire Gensler as a Professor of Practice focused on fintech and public policy has sparked debate around the appropriateness of such affiliations. Many in the crypto community view Gensler’s return as bewildering, especially considering his past regulatory actions that many argue curtailed innovation. The FinTechAI@CSAIL initiative he will co-lead has also drawn scrutiny, with critics suggesting that Gensler’s presence could stifle the innovation it aims to promote, impacting emerging technologies adversely.

Gemini’s stance against MIT is emblematic of a broader clash between innovation-driven sectors and regulatory frameworks. As the cryptocurrency landscape continues to evolve, the ongoing dialogue about the impact of regulatory bodies on technological advancement is likely to intensify. The ramifications of this conflict could shape hiring practices across the industry and influence the relationship between leading universities and emerging technological sectors. If firms like Gemini continue to take a stand against perceived regulatory overreach, we may witness a transformative shift in how the tech industry interacts with academic institutions and regulatory bodies moving forward.