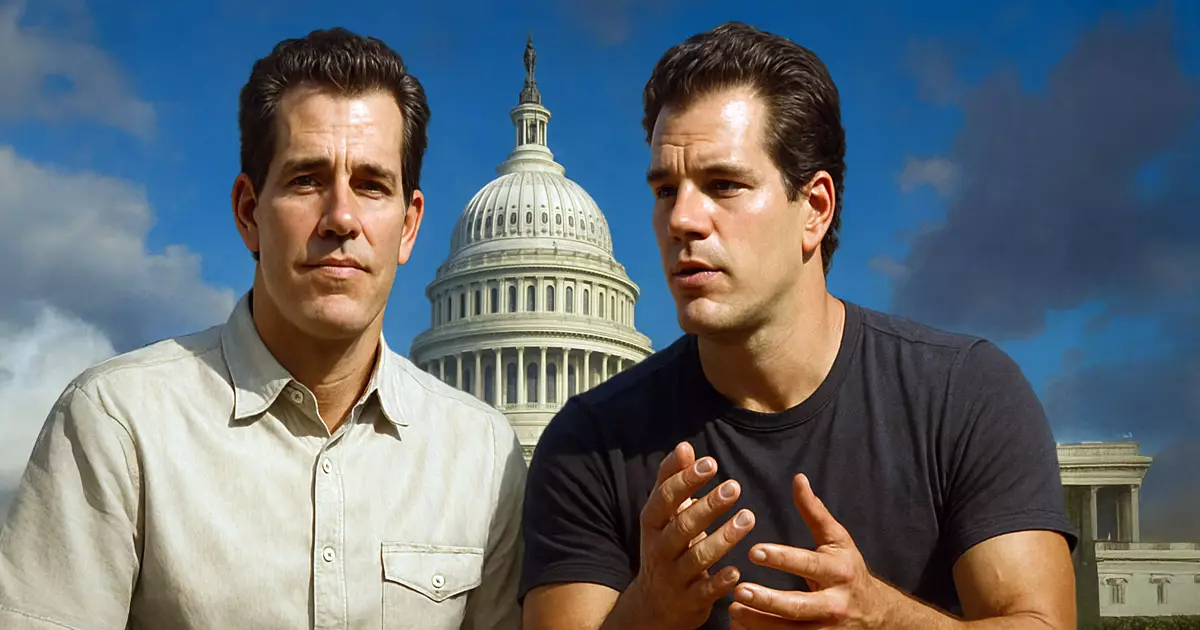

The recent audacious move by Cameron and Tyler Winklevoss to deploy over $21 million into a politically charged arena signals a shift in how cryptocurrencies are perceived as political tools. Their donation of 188.4547 Bitcoin to launch the Digital Freedom Fund PAC is more than financial muscle; it’s a declaration of intent to reshape America’s legislative landscape around digital assets. Rather than remaining on the fringes of investment, their approach advocates for active political engagement, pushing for legislation that champions cryptocurrency’s role in maintaining American innovation and economic sovereignty.

This infusion boldly positions the Winklevoss brothers as major players in political activism, emphasizing their vision of America as the global crypto hub. Their backing signals a growing recognition within the industry that policy and regulation will be decisive in determining whether digital currencies thrive or falter under bureaucratic overreach. It is a calculated strategy to influence primary races and midterm elections, with the aim of safeguarding the Republican control deemed essential for “America’s Golden Age” of technological leadership.

Legislative Aspirations: Balancing Innovation and Regulation

The PAC’s proposed “Skinny Market Structure Bill” offers a nuanced approach. Rather than pursuing sweeping regulation, it emphasizes clarity and protection for crypto users and developers, akin to the protections established for internet companies through Section 230. This analogy underscores their belief that the industry must be shielded from unnecessary bureaucratic liabilities that could stifle early-stage startups—many of which operate out of dorm rooms or garages.

The “Bitcoin and Crypto Bill of Rights” encapsulates core freedoms, emphasizing self-custody and peer-to-peer transactions. The Winklevoss vision paints regulation as a facilitator of innovation, not a hurdle, provided safeguards are in place. They see this legislation as a blueprint that defends ownership rights, ensuring ordinary Americans can participate freely in the digital economy without oppressive government interference. Such an agenda seeks to recalibrate the relationship between crypto entrepreneurs and regulators, advocating for a landscape where innovation is prioritized and overreach minimized.

Opposition to Central Bank Digital Currencies and Opaque Regulators

A central pillar of the PAC’s ideology is opposition to CBDCs, which they dismiss as “totalitarian technologies.” This stance reveals their suspicion of government control and surveillance-powered monetary systems, echoing center-right libertarian skepticism about centralized power influencing financial sovereignty. Their narrative frames CBDCs not merely as another policy issue but as instruments of authoritarianism in disguise, risking to erode individual freedoms.

They champion open banking and fair access, positioning themselves as defenders of the fundamental rights of consumers and small businesses. The push for rules that favor crypto firms over traditional financial institutions aligns with a broader resistance against entrenched interests exploiting regulatory loopholes. Their embrace of initiatives like “Project Crypto” and “Crypto Sprint” reflects optimism that proper regulatory frameworks can help mainstream digital currencies without compromising core principles of decentralization and user empowerment.

Balancing Act: Innovation Versus Political Power

The Winklevoss PAC operates at the nexus of innovation and power, seeking to tip the regulatory scales in favor of the crypto industry. Their vocal criticism of regulatory capture and the desire to democratize startup costs strikes a centrist chord, emphasizing fairness and accessibility. They argue that regulation should serve as a catalyst for growth rather than an obstacle designed to favor incumbents.

However, such bold advocacy invites inevitable questions. Is their stance a genuine effort to empower individual investors and startups, or a strategic move to secure long-term industry dominance? Their lack of disclosed leadership or organizational partners leaves some skeptical about the broader coalition behind this initiative. With their substantial financial backing, they are clearly positioning themselves as guardians of a future where digital assets become ingrained in the fabric of American financial and political life.

Ultimately, the Winklevoss brothers’ gamble encapsulates the volatile nature of the cryptocurrency movement: ambitious, optimistic, but fraught with risks of overreach and unintended consequences. Their push for “thoughtful regulation” and the rejection of CBDCs highlight a desire to safeguard liberty while navigating the perilous waters of political influence and economic dominance. As America’s political landscape edges closer to a crypto-fueled future, their actions will undoubtedly resonate across the corridors of power, testing whether the promise of digital freedom can withstand the weight of government authority.