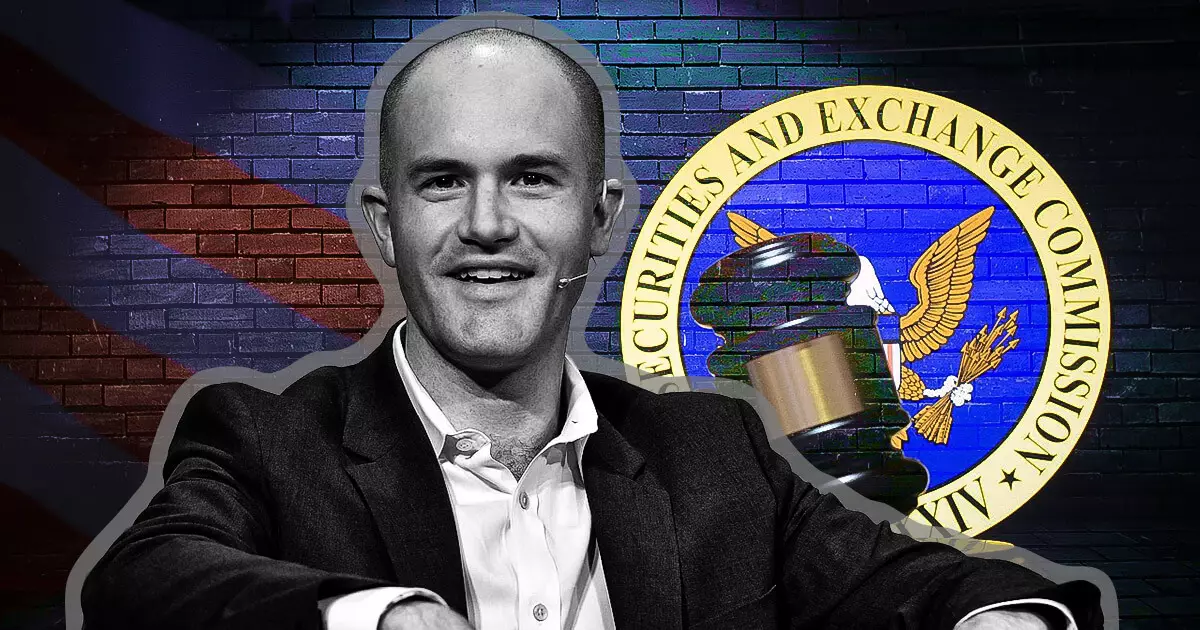

In a significant move that reflects the ongoing struggle between the cryptocurrency sector and regulatory bodies, Coinbase CEO Brian Armstrong has publicly declared the company’s intention to terminate partnerships with law firms that employ former officials involved in what he terms “unlawful” regulatory actions against the crypto industry. This decision, announced via social media on December 3, came on the heels of former SEC Division of Enforcement Director Gurbir S. Grewal joining the litigation group at Milbank. Armstrong’s pointed remarks serve as a clarion call for a reevaluation of legal partnerships within the rapidly evolving landscape of digital assets.

Concerns Over Regulatory Ethics

Armstrong’s comments raise pertinent questions about the ethical implications of hiring practices within legal firms that interface with the cryptocurrency industry. He did not hold back in his criticism, stating that senior partners often lack an adequate understanding of the complexities surrounding cryptocurrencies. This observation underscores a broader issue: many legal professionals may not fully grasp the challenges and innovations inherent in the crypto sector. By labeling Grewal’s actions as an “ethics violation,” Armstrong draws attention to a growing sentiment among crypto proponents that regulatory leaders are not only misguided but are actively sabotaging the industry’s potential.

Armstrong’s assertion that the previous SEC administration, under Gary Gensler, engaged in tactics that were not aligned with fair regulatory practices has sparked a broader conversation about regulatory clarity and fairness. He argues that the SEC’s approach toward cryptocurrencies lacked transparency and that ample opportunity existed for the agency to provide clearer compliance guidelines—a sentiment that resonates deeply within the crypto community. The history of increasing enforcement actions during Grewal’s tenure, culminating in significant lawsuits against Coinbase, has left many industry stakeholders feeling besieged and unprotected under what they perceive as an arbitrary regulatory framework.

The Implications of Armstong’s Announcement

The implications of Armstrong’s declaration extend beyond Coinbase’s legal strategy; they signal a potential shift in how the cryptocurrency industry navigates its complex relationship with regulatory bodies. By advocating for the withdrawal of financial support from legal firms that ally with regulatory officials perceived as antagonistic, Armstrong aims to galvanize industry players to take a stand. This could foster a greater alignment in the crypto community’s approach to advocacy, encouraging other firms to reconsider their legal partnerships and affiliations.

Milbank’s non-response to Armstrong’s statements highlights the tensions that persist between the crypto industry and traditional regulatory frameworks. Armstrong’s call to action seeks to empower the crypto sector to reclaim influence over its legal landscape. As the industry matures, it will likely encounter ongoing challenges, including the need for clearer guidelines and fair representation in regulatory discussions. Armstrong’s constituents may find solidarity in this relational shift, potentially leading to a more united front against regulatory overreach that could stymie innovation in the rapidly evolving world of digital assets.