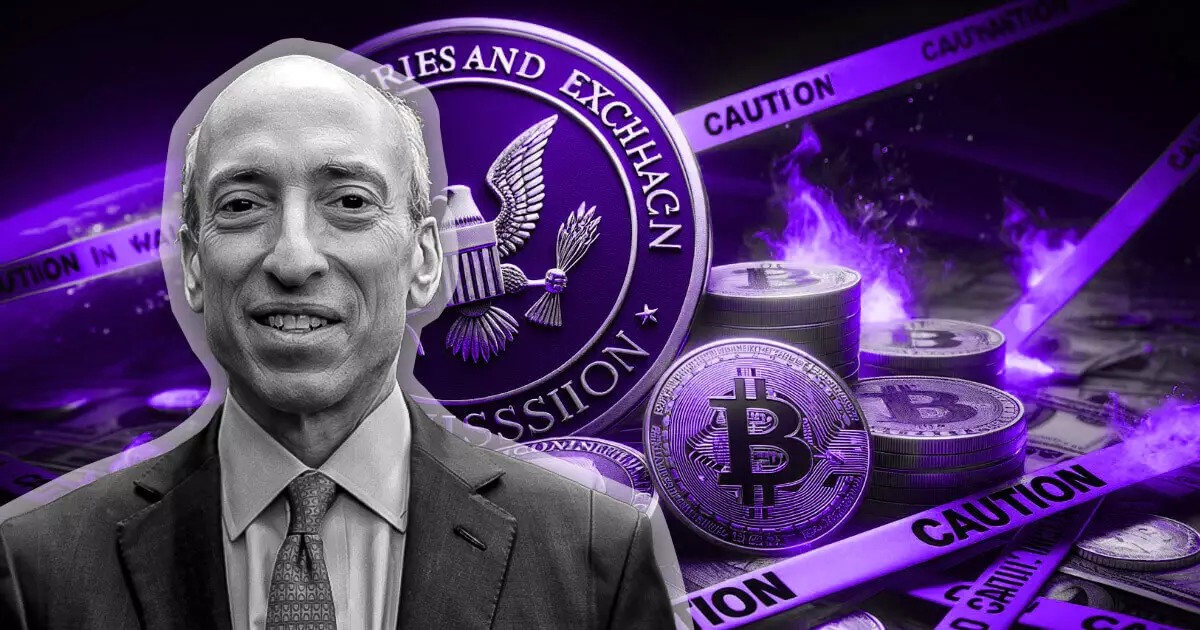

In a recent interview, Gary Gensler, Chair of the US Securities and Exchange Commission (SEC), clarified the regulatory status of Bitcoin, reaffirming that it does not fall under the classification of a security. This statement serves as a vital distinction for investors and the cryptocurrency market, especially as the industry grapples with increasing scrutiny. Gensler stated, “As it relates to Bitcoin, my predecessor and I have said that’s not a security,” emphasizing the notion that Bitcoin is regarded as a commodity under US law. This assertion came shortly after the SEC approved several spot Bitcoin exchange-traded funds (ETFs), enabling greater access for investors to the digital currency on major US exchanges, including Nasdaq.

While Gensler’s comments provide clarity regarding Bitcoin, they also indicate a critical perspective on the broader cryptocurrency ecosystem. He criticized many players within the industry for neglecting established regulations, suggesting that non-compliance has led to market instability. “There are rules in place, but many have chosen to ignore them,” he noted, highlighting an ongoing challenge for regulators. This nonchalant attitude towards regulations by some market participants has contributed to an atmosphere of confusion and volatility, raising alarms about investor protection.

In stark contrast to Bitcoin’s status, Ethereum finds itself in a grey area regarding regulatory classification. The SEC has yet to define Ethereum as either a security or a non-security, leading to uncertainty for projects developed on its blockchain. Although the SEC has approved ETFs tied to Ethereum, it has launched investigations into various companies within the Ethereum ecosystem, such as ConsenSys and Uniswap. This dual approach has ignited debates on Capitol Hill, with members of Congress criticizing Gensler for potentially muddying the waters around regulatory definitions, particularly with phrases like “crypto asset security.”

The frustration from lawmakers has been palpable, as many believe that the SEC’s indecisive stance is stifling innovation in the cryptocurrency space. Critiques from within the SEC itself, notably from Commissioners Hester Peirce and Mark Uyeda, mirror these sentiments, with calls for clearer regulations echoing through the halls of Congress. These criticisms center around the idea that despite possessing the capability to create a more definitive regulatory framework, the SEC has failed to do so, leaving many stakeholders in limbo.

Despite pushback from various quarters, Gensler remains steadfast in his belief that a robust regulatory environment is essential for the future of cryptocurrencies. He pointed out that for the industry to thrive and attract investors, building trust is paramount. In his view, effective regulations act as the “traffic lights and stop signs” necessary for a mature marketplace. This analogy underscores the necessity of establishing clear rules to ensure safety and reliability, allowing the crypto industry to develop in tandem with public confidence.

As the SEC continues to navigate the complexities of digital assets, the contrasting treatment of Bitcoin and Ethereum encapsulates the broader challenges in creating a coherent and fair regulatory framework. The industry stands at a crossroads, where clarity and compliance will be crucial in shaping its future.