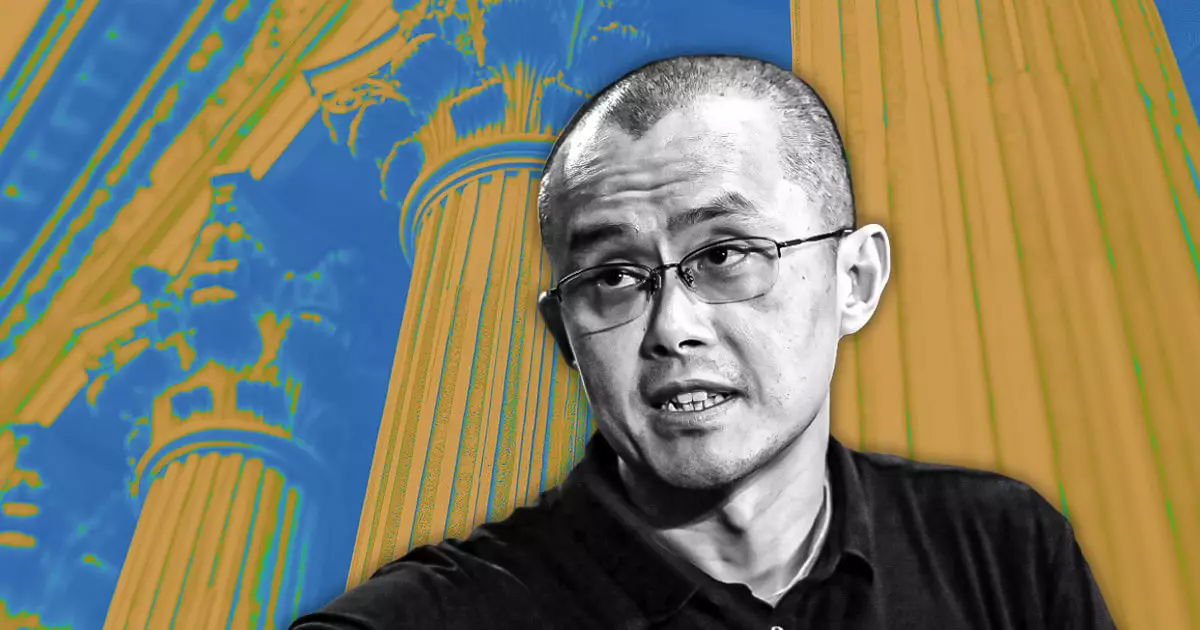

The cryptocurrency market is known for its volatility and the rapid spread of information, both accurate and misleading. On February 17, Changpeng Zhao, commonly known as CZ, the founder and former CEO of Binance, firmly denied rumors suggesting that the leading cryptocurrency exchange was seeking a buyer. This speculation ignited discussions among crypto enthusiasts and investors after a noticeable decrease in Binance’s asset holdings raised eyebrows. CZ labeled these rumors as “misinformation,” attributing them to competitive actions from other entities within the Asian market. The exchange has consistently denied intentions for a full sale, instead hinting at the potential acceptance of minority stake investments in the future.

The Landscape of Strategic Investments

While CZ has made it clear that a complete acquisition of Binance is off the table, he acknowledged the ongoing interest from investors in acquiring small ownership stakes. He remarked, “Top investors have always been interested in Binance,” indicating a robust appetite for involvement from external parties. This shift towards possible minority stakes reveals a desire for continued growth and the influx of fresh capital without sacrificing control over the exchange’s operations. Binance co-founder Yi He echoed this sentiment, emphasizing the consistent interest from investors and the openness to discuss possible mergers or acquisitions, although no immediate plans for significant ownership dilution are in place.

Responding to Asset Management Concerns

The rumors surfaced following a close examination of Binance’s asset management strategies, particularly when users noted the exchange’s substantial decreases in holdings of major cryptocurrencies, prompting concerns about the company’s financial stability. However, Binance reassured users that these alterations were purely internal adjustments pertaining to its treasury management, and not indicative of a broader financial distress. The exchange underscored its commitment to user security by asserting that all user assets remain fully backed on a one-to-one basis, a crucial clarification to mitigate any potential panic among the community.

Adding another layer to the complexity, Binance faces ongoing regulatory scrutiny, which has exacerbated concerns regarding its operational longevity. Speculations intensified following a viral post on Chinese social media, which insinuated that Binance’s market maneuvers were in response to regulatory challenges and a strategic pivot towards decentralized exchanges (DEXs). Such challenges may require Binance to reassess its operational frameworks to remain competitive. Despite these pressures, Binance remains the world’s largest crypto exchange by trading volume, effectively processing billions in transactions each day.

Looking ahead, the prospect of accepting minority investments could signify a strategic pivot for Binance, allowing institutional investors to gain a foothold in one of the most influential exchanges globally. Historically, Binance has shied away from outside investment and maintained a relatively private ownership structure. However, the growing competition from other centralized exchanges (CEXs) might necessitate a reevaluation of this approach. Should Binance open its doors to select external stakeholders, it could fortify its financial position while retaining operational autonomy, a delicate balance crucial to navigating the ever-evolving landscape of the cryptocurrency sector.

While recent rumors have stirred uncertainty, Binance remains steadfast in its principles, highlighting its operational integrity and future-focused strategies amid a shifting regulatory and competitive climate.