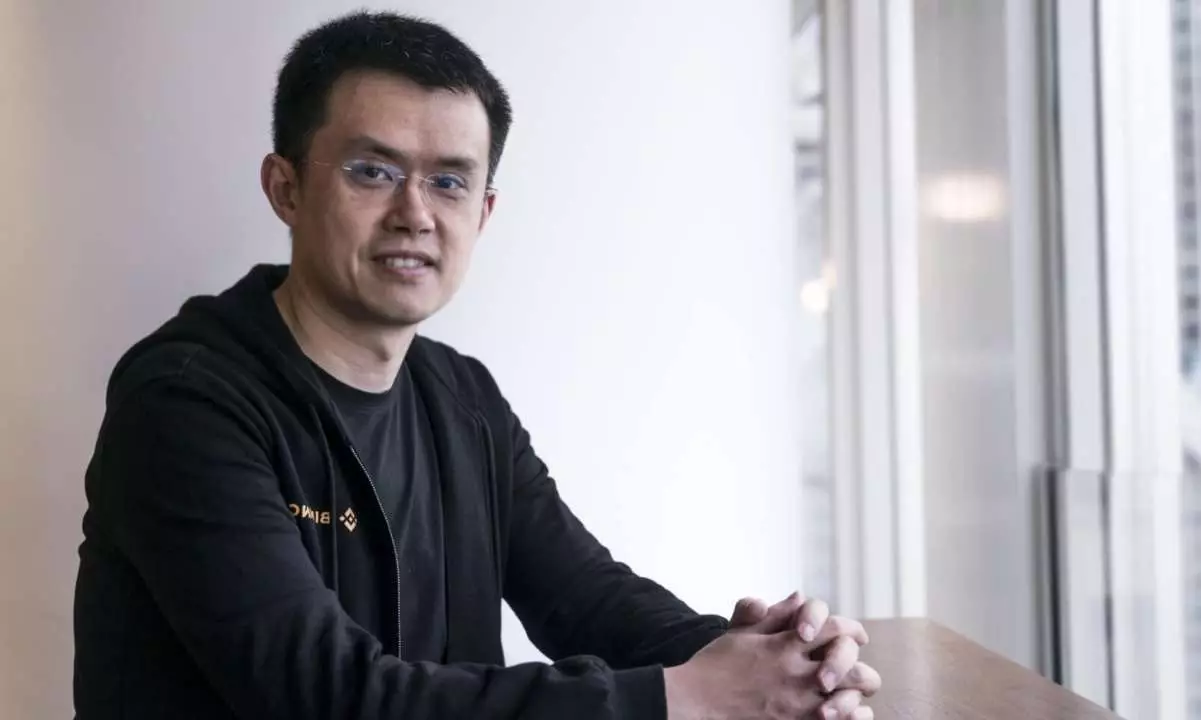

The recent hack of Bybit, one of the leading cryptocurrency exchanges, has sent shockwaves through the crypto community, raising important questions about security infrastructure within blockchain-based platforms. Former CEO of Binance, Changpeng Zhao, commonly referred to as CZ, has criticized Safe Wallet’s post-mortem report regarding the attack, highlighting key concerns about the effectiveness of the responses provided. This incident, where nearly $1.5 billion in assets were compromised, serves as a crucial reminder of the vulnerabilities that tech platforms face, particularly in the burgeoning world of cryptocurrencies.

Initial investigations into the breach revealed that the exploit stemmed from compromised credentials associated with Safe Wallet. Despite assurances from Safe Wallet that vulnerabilities in their smart contracts or front-end code were not the root cause, CZ’s skepticism casts a shadow over these claims. He pointedly remarked that Safe’s explanation was too vague, leaving stakeholders with more questions than clarity. The situation raises an essential question: Was the breach an isolated incident due to flawed infrastructure, or does it point to deeper systemic issues within the security protocols employed by cryptocurrency exchanges?

The audit report, which investigated the attack, indicated that an exploit derived from a developer machine compromised by a malicious actor. According to the forensic analysis, the breach was enabled by the use of “malicious JavaScript code,” stealthily injected into Safe’s Amazon Web Services environment just days prior to the attack. Herein lies a crucial security concern; if the code could infiltrate a trusted network, then the barriers around security for cryptocurrency exchanges need reevaluation.

Transparent communication during crises is vital for maintaining stakeholder trust, and CZ’s criticisms of Safe Wallet illustrate the importance of clear, unambiguous reporting. It is critical that companies address stakeholder concerns directly and comprehensively, rather than glossing over the issues with unclear jargon that can lead to further confusion. Trust in cryptocurrency exchanges is already tenuous; incidents like this can greatly erode the confidence that users and investors have in these platforms.

Moreover, the inadequacies in Safe’s preliminary communication suggest a potential gap in crisis management strategies within tech firms. The reluctance to provide detailed explanations can lead not only to a loss of trust but also to severe reputational damage that could have long-lasting effects. Stakeholders will rightfully demand thorough accountability, and concise explanations of vulnerabilities, remediation processes, and steps to prevent future occurrences must be prioritized.

The fact that attackers were able to maneuver through the security systems without raising alarms is a significant wake-up call for cryptocurrency exchanges. Questions raised by CZ concerning the methods of compromise—including the potential for social engineering or direct manipulation of code—underline the need for enhanced security architecture and protocols that go beyond traditional firewalls and encryption.

This incident emphasizes the importance of adopting a multi-layered approach to security, combining technological solutions with human awareness and agility. Regular audits, real-time monitoring, and rigorous testing of security systems should become standard operating procedures across all exchanges to mitigate the risk of similar future incidents.

Additionally, education on recognizing social engineering attempts among developers and system admins could be as essential as the technical safeguards put in place. The intersection of technology and human factors cannot be overstated in preventing breaches of this magnitude.

The Bybit hack serves as a potent reminder of the fragility of security within the cryptocurrency ecosystem. As the digital currency landscape continues to evolve, so too must the security measures that protect it. The criticisms levied by CZ, alongside the subsequent forensic findings, highlight the urgent need for systemic reform in both communication and security practices in the crypto space.

Moving forward, stakeholders within the cryptocurrency community must prioritize transparency, engage in more robust security protocols, and foster an environment of responsibility that ensures the safeguarding of assets. Only through vigilance and collective effort can the trust essential for the growth of the cryptocurrency market be restored.