In a realm where geopolitical and economic uncertainties loom large, Ethereum finds itself trapped in a turbulent market that continues to oscillate between hope and despair. As of late 2023, Ethereum trades precariously at a resistance point that has many industry watchers apprehensive about its trajectory. The broader economic landscape is marred by ongoing tensions between the United States and China, which has not only affected stock markets but has also rippled through the cryptocurrency sphere. The recent announcement from the Trump administration to pause tariffs for 90 days, with the glaring exception of China, sends a clear signal: the specter of a drawn-out trade war is still present. Investors are left grappling with the likelihood that any further destabilization could swing Ethereum’s fortunes downward, but therein lies an opportunity masked by volatility.

The Crypto Analyst’s Dilemma: Risk vs. Reward

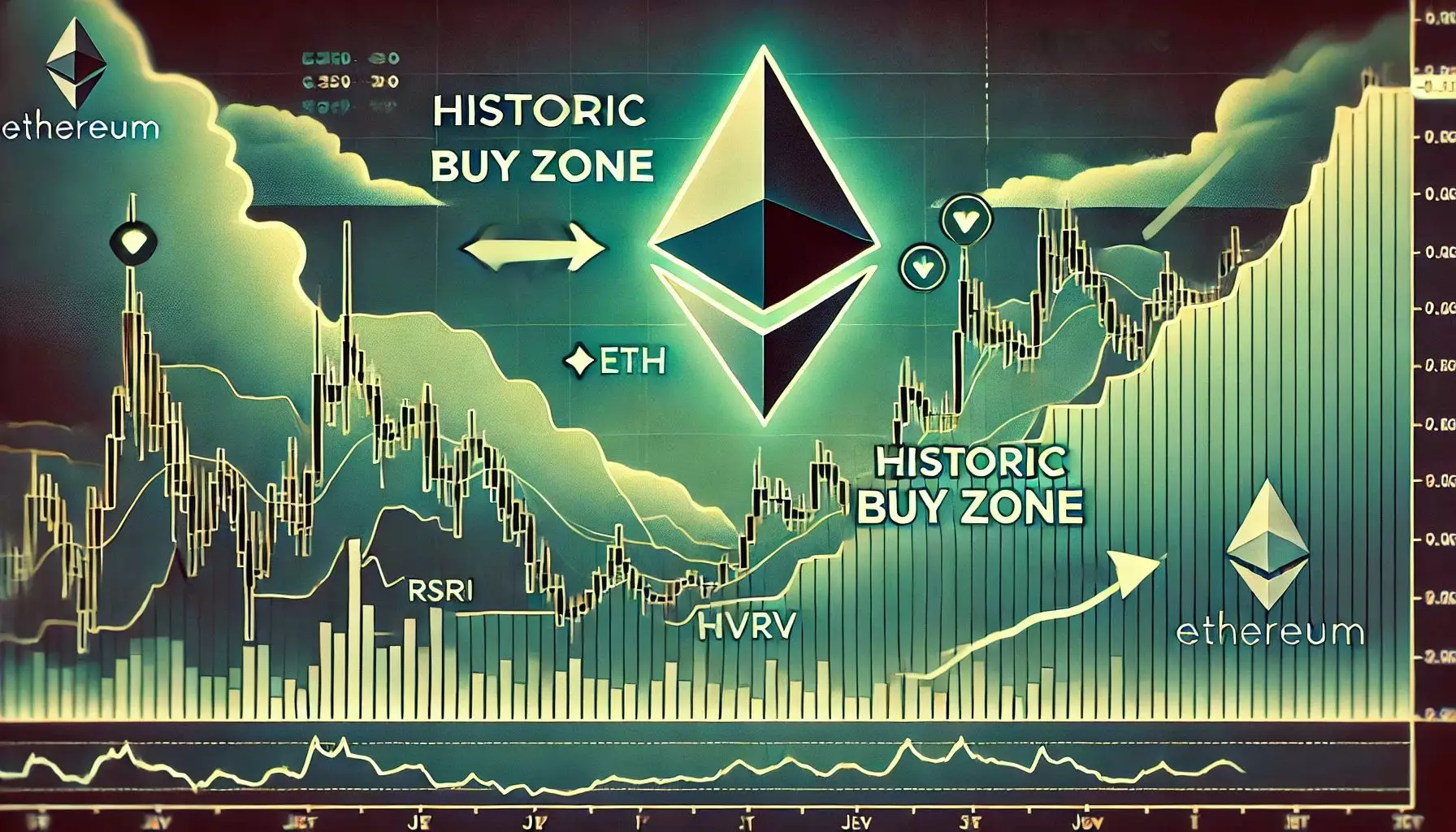

Amid this chaos, seasoned analysts are giving Ethereum a closer look, particularly with respect to its performance relative to historical market metrics. Top crypto analyst Ali Martinez identifies a critical point—the MVRV (Market Value to Realized Value) Price Band. Traditionally seen as a reliable predictor of undervaluation, the lower bounds of this band now mark a critical juncture for investors. Brace yourselves: ETH is trading right within what some perceive as a “buy zone.” While it sounds enticing to consider accumulating at a discount, there are stark questions lurking beneath the surface. Are we genuinely witnessing a potential turnaround, or are we just a breath away from capitulation?

Tensions in the larger economic landscape have made many investors understandably jittery, spurring a trend toward the sidelines. Those who once embraced cryptocurrencies with open arms now hesitate, casting wary glances as they re-evaluate their risk appetite. Should we embrace the bullish potential that often surfaces after sharp downturns, or are we simply courting disaster? The layered complexities of Ethereum’s standing amidst macroeconomic turbulence compel us to consider this fragile balancing act.

Technical Analysis: The Tug of War Between Bulls and Bears

Ethereum has faced a strong headwind in recent weeks, particularly after it surrendered the psychologically significant $2,000 threshold—a level that had historically marked stability and bullish momentum. This has driven Ethereum into a painful 21% decline, where market sentiment has soured considerably. The dip below the $1,700 resistance is telling; bulls have been unable to reclaim even modest control. Instead, traders find themselves caught in a constricted trading range of $1,550 to $1,630, symbolizing more than just uncertainty; it’s a state of market paralysis.

In moments of such price compression, you would expect a significant breakout—either upwards or downwards—to materialize. The positional advantage that Ethereum once held seems to evaporate the more it hovers near the $1,550 support zone. Should that floor crack, the implications could be dire, signaling a deeper correction and slumping morale. Conversely, a sharp reset above $2,000 could launch a fresh wave of optimism, invigorating investor interest that has waned amidst the downturn.

The Investor’s Conundrum: Should You Bet on Ethereum?

As we navigate these murky waters, the question becomes increasingly complicated: Is Ethereum poised for a major rebound, or is it approaching a precipice? Investors looking to harness what could be a 50% upside might find themselves wrestling with anxiety. The psychology surrounding investing in cryptocurrencies is particularly fraught; the allure of jumping in at low prices is counterbalanced by the very real risk of losing significant capital should bearish trends persist.

The sentiment surrounding cryptocurrency markets often resembles a pendulum, swinging wildly between exuberance and despair. This bipolarity complicates the decision-making process for prudent investors. While the current conditions signal a potentially rare buying opportunity, it requires a steely resolve to buck the trend of pessimism and act decisively. Ethereum may indeed be flirting with a strategic buy zone, but market dynamics invite skepticism. Astute investors should weigh the possible scenarios carefully: will they be rewarded for courage or suffer losses due to flaws in timing?

In the end, Ethereum’s path forward remains an enigma shrouded in both potential and peril, making it a fascinating yet anxiety-inducing prospect for those engaged in its mercurial embrace. As we watch to see how it responds to both technical indicators and broader economic pressures, one thing is certain—the duality of opportunity and risk remains the essence of the crypto world.