The cryptocurrency landscape, particularly dominated by Bitcoin, has been anything but stable in the past months. After fascinating investors with a meteoric rise, where it surpassed the $100,000 mark, Bitcoin became a subject of intense media scrutiny. This period of soaring prices quickly gave way to a more turbulent phase, characterized by extreme volatility within a narrow price range. The market’s apprehension reached a peak when Bitcoin plummeted below the $80,000 threshold, marking a significant downturn that left many investors shaken.

Leading up to this drop, Bitcoin had maintained a price range between $92,000 and $106,000 for approximately 75 days. However, this range-bound behavior signified a buildup of pressure that eventually resulted in a sudden market correction. The exodus of Bitcoin “whales” — large holders of Bitcoin — became apparent as they began offloading their assets, contributing to the overall downturn. This selling pressure was exacerbated by diminishing network activity and a decline in the hash rate, indicating a potential retreat from the bullish momentum that had pervaded earlier.

Bitcoin’s struggles do not exist in isolation; they reflect broader economic trends that are impacting various asset classes. With the advent of a pro-reform administration in Washington, there is an ongoing recalibration within the economy, creating waves in both traditional and digital markets. Stocks experienced a notable downturn, with the NASDAQ Composite index shedding 3.5% in a week. Precious metals like gold also saw declines, with futures dropping 2.92%. These market movements suggest that Bitcoin’s circumstances are symptomatic of larger macroeconomic forces at play.

As consumer confidence wanes, evidenced by the first drop in consumer spending in two years, it becomes increasingly clear that sentiment around economic stability is fragile. Thus, Bitcoin’s pricing struggles can be interpreted as a reflection of these shifting macroeconomic tides, drawing in both institutional and retail investors as they navigate an uncertain financial landscape.

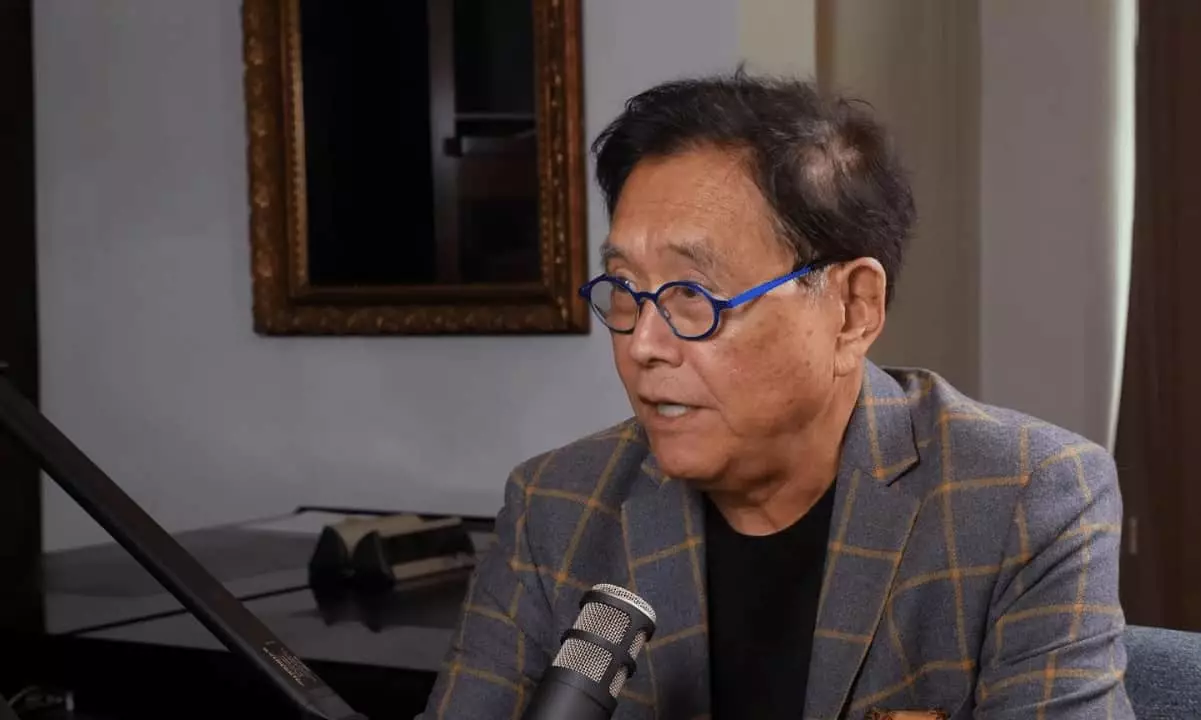

Despite the current challenges facing Bitcoin, there are voices that maintain a bullish outlook for the cryptocurrency. Notable figures, such as Robert Kiyosaki, express optimism about Bitcoin’s future. Kiyosaki refers to the cryptocurrency as being on “SALE,” emphasizing that the true issue lies not within Bitcoin itself, but rather in the inadequacies of the current monetary system. He articulates concerns about the staggering national debt and burgeoning unfunded obligations in the U.S., which only amplify the case for Bitcoin as a stable store of value.

Furthermore, analysts like BitMEX founder Arthur Hayes predict that markets may bounce back after experiencing violent corrections, suggesting that a temporary drop might serve as a shaking off of weaker market participants. This sentiment reflects the classic investment psychology where fear can often lead to substantial recovery opportunities, as traders may flock back to Bitcoin, recognizing its potential amidst market turmoil.

As Bitcoin begins to regain its footing post-correction, the dynamics of market behavior suggest that investors are once again considering the opportunities presented by its current valuations. The rise in search activity for “buy the dip” hints at a resurgent bullish sentiment, potentially indicating that the bears may have overreacted. While the future remains uncertain, the resilience displayed by Bitcoin throughout its tumultuous journey serves as a testament to its enduring significance in the world of finance.