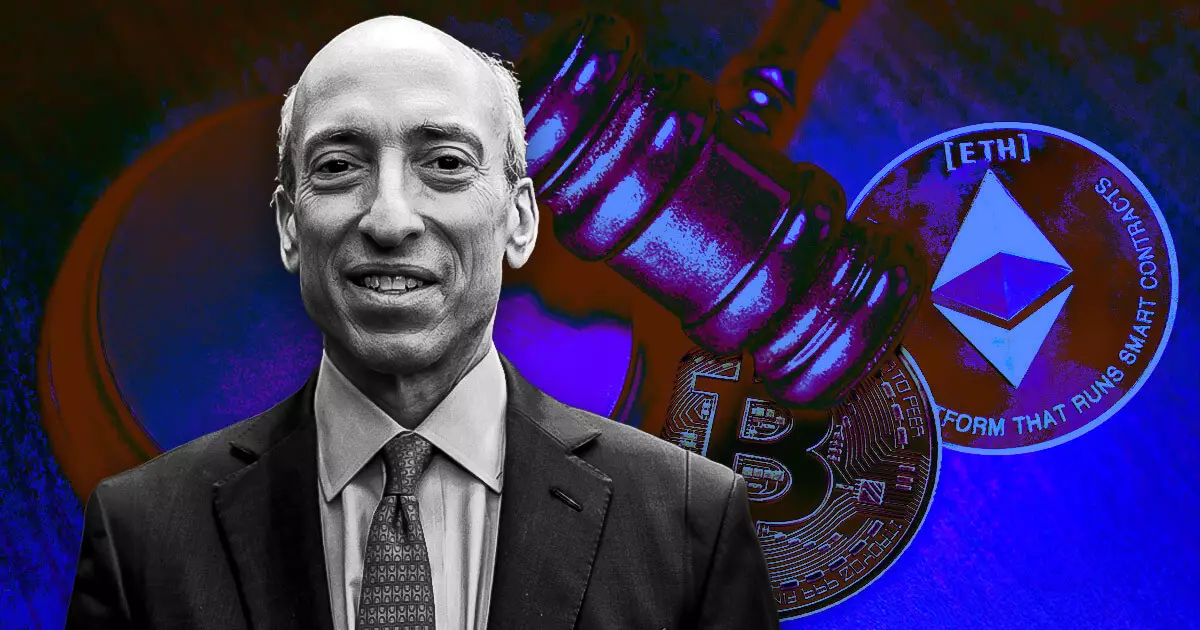

The evolving landscape of cryptocurrency investment products has encountered another obstacle as the United States Securities and Exchange Commission (SEC) is set to reject applications for two spot Solana (SOL) exchange-traded funds (ETFs). This decision, attributed to SEC Chair Gary Gensler—whose term is due to end on January 20, 2025—has raised eyebrows and brought about significant discussions in financial circles. Senior Bloomberg ETF analyst Eric Balchunas suggested that this rejection may be seen as Gensler’s “parting gift” to the crypto industry, marking a definitive stance before a transition in leadership at the SEC.

Market analysts have indicated that Gensler’s decision reflects a broader hesitation by the SEC to embrace new crypto-related financial products. According to sources cited by Fox News, insiders at the Solana ETF issuers revealed that under Gensler, the SEC has effectively closed the door to additional crypto ETFs—a move that could, at least temporarily, dampen investor enthusiasm and confidence in Solana’s potential in the financial markets.

The SEC’s reasoning for the rejection hinges upon the regulator’s existing classification of cryptocurrencies as securities in various ongoing lawsuits. James Seyffart, another ETF analyst at Bloomberg, articulated that it would be contradictory for the SEC to greenlight SOL-related products when they are simultaneously arguing that Solana constitutes a security. This apparent dichotomy showcases the regulatory challenges that the crypto industry continues to face. For now, Seyffart believes that the current applications for Solana ETFs are “dead in the water” until a new SEC administration can provide clarity in the regulatory framework regarding digital assets.

This uncertainty in the approval process for Solana ETFs is likely to set back the timeline for potential launch and trading until at least August 2025, a date which Seyffart acknowledges could see further delays. He notes that the SEC’s recent actions regarding ongoing cases, such as the one involving Binance, reflect a significant regulatory scrutiny that envelops the crypto market, complicating the landscape for potential investment products.

Looking forward, the discussion surrounding the future of the Solana ETFs will largely depend on who takes the helm of the SEC post-Gensler. Expectedly, Paul Atkins, confirmed for the role by President-elect Donald Trump, may usher in a new approach towards cryptocurrency regulation. Analysts predict that the atmosphere surrounding crypto ETFs could become more favorable with new leadership and a shift in the regulatory framework.

As stakeholders await this shift, former VanEck digital asset strategy director Gabor Gurbacs underscored the broader excitement and apprehension that pervades the industry. The transitions in regulatory oversight reflect the underlying tensions and the need for a coherent plan that reconciles innovation in financial products with the rigorous demands of federal oversight.

The future of Solana ETFs hangs in a delicate balance, with ongoing lawsuits, SEC classifications, and impending leadership changes all playing pivotal roles. The industry appears hopeful for a resolution that supports the growth of cryptocurrency markets while adhering to the necessary legal frameworks, yet uncertainty looms large in this dynamic environment.