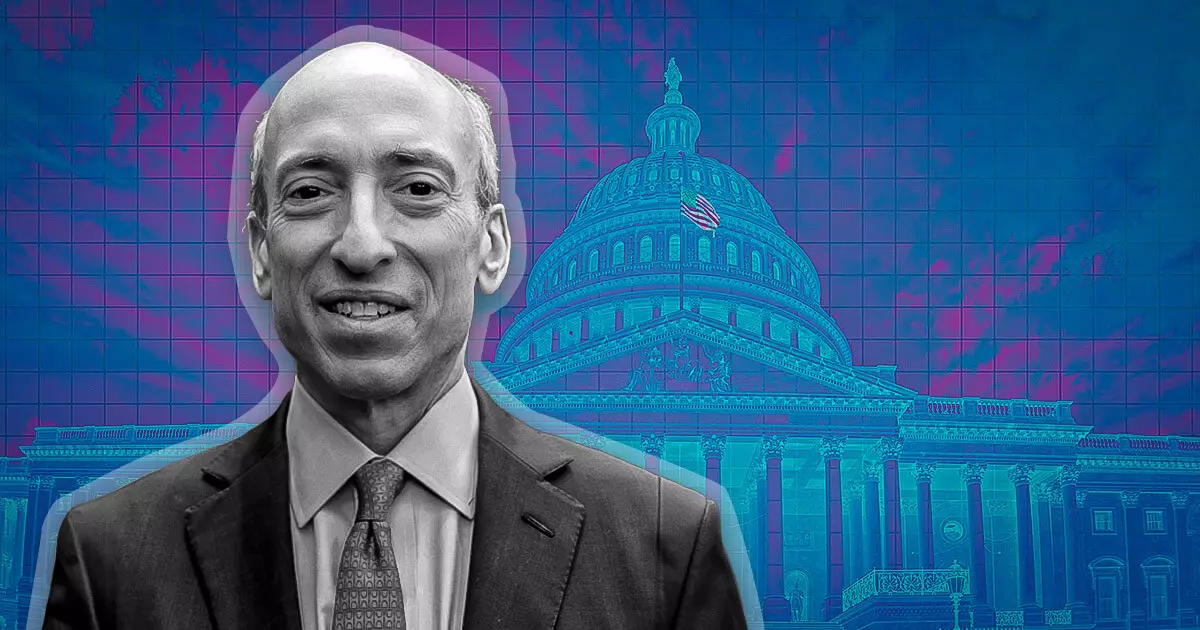

The landscape of cryptocurrency regulation in the United States has become increasingly contentious, particularly under the leadership of Gary Gensler, chair of the U.S. Securities and Exchange Commission (SEC). Recent comments from notable figures, including Tyler Winklevoss, co-founder of the Gemini crypto exchange and a vocal critic of Gensler, have brought renewed attention to the chair’s regulatory practices and their implications for the burgeoning industry. This article will delve into the criticisms aimed at Gensler, explore the broader ramifications for the cryptocurrency market, and assess the underlying tensions between regulation and innovation.

Tyler Winklevoss has not held back in his assessment of Gensler’s actions, arguing that they are far from innocent missteps. According to Winklevoss, Gensler’s regulatory maneuvers are characterized by a deliberate intent to serve a personal political agenda, thus raising serious concerns about the integrity of his position. By framing his actions in this manner, Winklevoss paints Gensler not merely as an overzealous regulator but as a proactive agent of destruction against an emerging industry. This characterization is noteworthy as it speaks to the wider anxieties within the crypto community about the balance of power in regulatory agencies and their potential to stifle innovation through excessive scrutiny.

Moreover, Winklevoss’s assertion that Gensler is “evil” underlines a growing narrative among advocates for cryptocurrency. These advocates argue that Gensler’s aggressive regulatory stance not only jeopardizes jobs and investments but also could diminish America’s competitive edge in fintech innovation. Such a perspective highlights the contrasting views within financial sectors, where traditional institutions see regulation as necessary for stability, while technological pioneers argue that such frameworks may hinder their growth.

Winklevoss indicates that the ramifications of Gensler’s approach to cryptocurrency regulation extend far beyond mere regulatory overreach. He argues that Gensler’s interpretations of regulatory frameworks and his reliance on the “regulation through enforcement” doctrine have instilled a sense of fear and unpredictability in the cryptocurrency market. This has profound implications: investors may hesitate to engage with digital assets, startups could be discouraged from pursuing funding, and established entities may reevaluate their operational strategies in light of an uncertain regulatory atmosphere.

Adding to this climate of apprehension, 18 U.S. states recently filed a lawsuit against the SEC and Gensler, alleging gross overreach by the agency. This legal action signifies not just a disconnect between state interests and federal regulation, but also highlights a concerning trend where existing regulatory bodies are perceived as potential adversaries rather than protective entities.

A Political Battlefield

The situation around Gensler’s leadership has drawn the attention of political figures as well. Former President Donald Trump has publicly vowed to dismiss Gensler should he regain office, reflecting a view that resonates with elements of the political right who advocate for reduced government intervention in the economy. This proposed action raises critical questions about the independence of regulatory bodies. Even though the President does not have the authority to terminate an SEC chair, this political discourse emphasizes the contentious role Gensler plays in the public sector’s relationship with the private economy.

Winklevoss’s claim that any institution hiring Gensler post-SEC should face public backlash illustrates the rising ire in the crypto community and suggests a future of intensified scrutiny and judgment over regulatory leaders. Such sentiments embody a broader cultural shift that weighs the accountability of public servants against their performance, particularly when their decisions may lead to widespread economic consequences.

The implications of Gary Gensler’s policies as SEC chair will continue to reverberate throughout the cryptocurrency landscape. As Tyler Winklevoss articulates, the consequences of these decisions may be irrevocable, potentially undermining the potential growth of a sector that promises innovation and economic opportunity. The discussions surrounding Gensler underscore an urgent need for a balanced approach to regulation—one that fosters innovation while protecting investors and the public interest.

As the cryptocurrency market continues to evolve, a dialogue between regulators and industry stakeholders must emerge to forge a path that is both protective and enabling, ensuring that America remains a global leader in technological advancement without stifling creativity and entrepreneurial spirit. The stakes are high, and the outcome of this regulatory struggle may shape the future direction of finance and technology in the years to come.