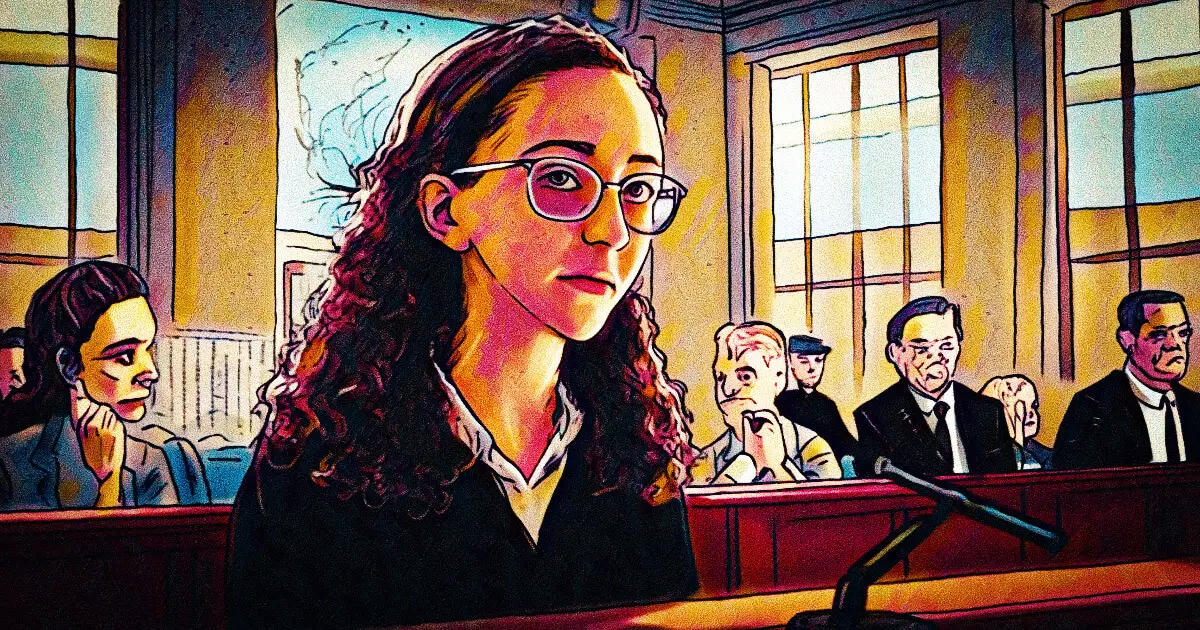

The world of cryptocurrency has experienced its own version of chaos and drama with the notorious collapse of FTX, once celebrated as a leading exchange in the digital currency market. At the heart of this financial debacle lies Caroline Ellison, the former CEO of Alameda Research and a vital figure in what was, until recently, a formidable enterprise led by Sam Bankman-Fried. The repercussions of the FTX downfall reached far and wide, culminating in Ellison’s recent sentencing to two years in prison, alongside an order to forfeit $11 billion due to her involvement in this catastrophic event.

On September 24, 2023, the court issued a ruling that reaffirmed the severity of financial misconduct in the crypto landscape. Ellison’s request for leniency was grounded in her assertion that her testimony against Bankman-Fried was pivotal in his conviction—resulting in a staggering 25-year prison sentence for fraud. This plea to the court highlights the complex interplay between individual accountability and the broader implications of corporate governance within the realm of cryptocurrency, where regulations still struggle to keep pace with rapid technological advancements.

Ellison’s defense was fortified by her considerable cooperation with federal authorities post-FTX’s collapse, a strategic move that her legal team emphasized in their arguments. Her return to the United States from the Bahamas and her willingness to assist investigators in untangling the intricate web of financial mismanagement at both FTX and Alameda Research were cited as mitigating factors deserving of mercy. Yet, the duality of her actions raises moral questions: does cooperation sufficiently absolve one from wrongdoing, particularly when the fallout of one’s actions affects thousands of investors?

Despite her commitment to aiding investigators, Ellison’s involvement in the very practices that led to FTX’s demise casts a long shadow over her character. Her defense invoked a narrative portraying her as a victim of Bankman-Fried’s manipulative influence, alleging that she was ensnared in a murky mix of romantic and professional entanglements. However, this victimization theme may inadvertently downplay the need for personal accountability. Is it justifiable to attribute one’s unethical decisions solely to external pressures, when financial expertise and administrative powers were at play?

Ellison’s sentencing is not an isolated event; it is part of a larger reckoning involving other executives from FTX. While she may have played a critical role in providing information leading to Bankman-Fried’s conviction, the legal consequences for other key figures serve as a sobering reminder of the systemic issues within the cryptocurrency industry. With Ryan Salame receiving a seven and a half year sentence and other executives awaiting their fates, it becomes evident that the courtroom is a stage where the curtain rises on a broader indictment of rogue practices that permeate the cryptocurrency market.

As the dust settles from the FTX scandal, Caroline Ellison’s story serves as a cautionary tale. It reflects not only the personal consequences of greed and malfeasance in a burgeoning industry but also raises fundamental questions about accountability in the financial ecosystem. As cryptocurrency continues to evolve, the need for robust regulatory frameworks becomes ever more crucial to protect consumers and maintain the integrity of the financial system. In the end, Ellison’s two-year prison term stands as both punishment and a complex commentary on moral ambiguity in a tumultuous sector.