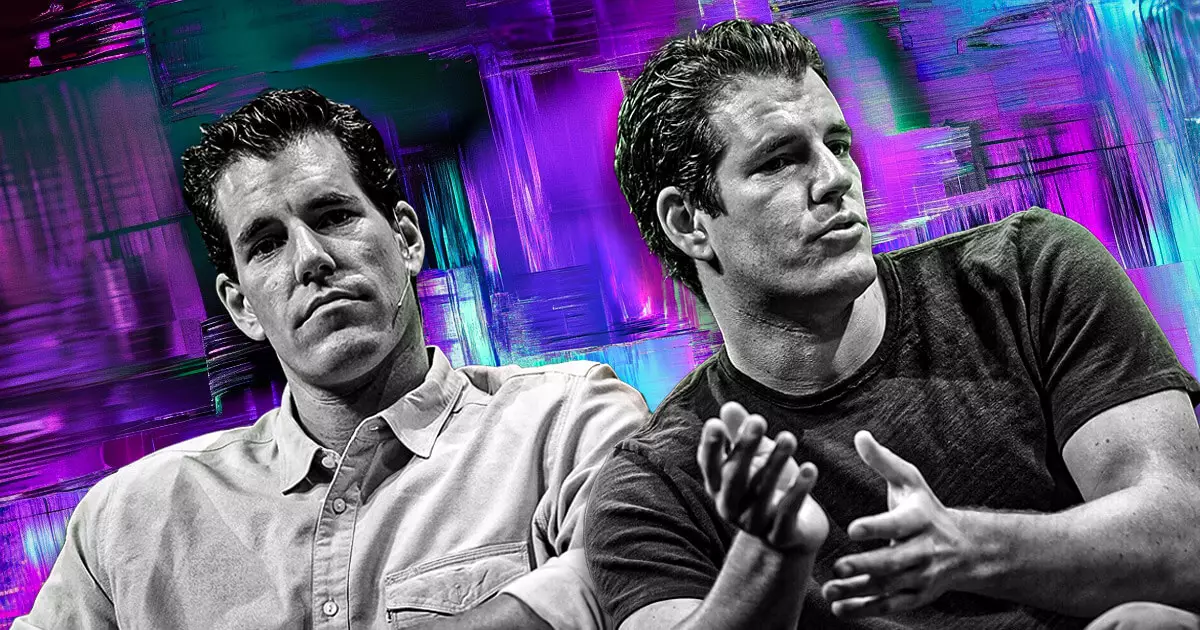

Gemini, the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, has taken a bold step by filing a draft registration statement with the U.S. Securities and Exchange Commission (SEC) to launch an initial public offering (IPO) of Class A common stock. This decision, disclosed in a statement on June 6, not only represents a leap for Gemini but could also serve as a significant catalyst for the broader digital asset marketplace. With market conditions becoming increasingly favorable, the Winklevoss twins are executing a plan that has the potential to transform investor perceptions of crypto assets altogether.

The Timing of the IPO

Market timing is everything in the world of finance, and Gemini’s decision comes on the heels of notable successes in crypto-related IPOs. Just recently, stablecoin issuer Circle made headlines with a spectacular debut on the New York Stock Exchange, skyrocketing from an initial share price of $31 to a remarkable high of $123.52 within mere hours. This performance signals to potential investors that there is a robust appetite for well-managed digital asset firms. It stands to reason that Gemini’s executive team felt encouraged by Circle’s success and the current sociopolitical landscape, which seems increasingly amenable to digital asset operations under a pro-crypto administration.

The Role of Regulatory Compliance

While the excitement surrounding the IPO is palpable, it is crucial to acknowledge that Gemini must address several regulatory hurdles before any shares can be sold to investors. The SEC’s comments must be heeded, financial statements need updating, and offer details must be reconciled. Some skeptics might argue that the regulatory landscape is still a minefield for cryptocurrency firms, but the resulting compliance could also serve as a blueprint for future market entrants, laying down a safer pathway in what has often been seen as the Wild West of investing.

The Ripple Effect on the Crypto Space

What’s immensely intriguing is how Gemini’s IPO might set off a chain reaction among other digital asset companies eyeing the public market. Industry insiders suggest that major players like Kraken are also contemplating their public listings, bolstered by investment banks signaling a “go time” sentiment. This clarity from well-regarded financial institutions could embolden other crypto startups to join the fray, thus accelerating the adoption of digital assets in the mainstream financial environment.

The Evidence of Market Maturity

With a competitive offering emerging from companies like Circle, combined with Gemini’s upcoming IPO, the narrative surrounding cryptocurrencies is evolving. Once regarded as a fringe element of the financial system, digital assets are now being taken seriously by investors — especially those looking for revenue-generating platforms. This newfound maturity aids in reinforcing the credibility of crypto in broader investment portfolios, appealing to traditional investors who have been hesitant to engage.

Final Thoughts: A Risk Worth Taking

Despite the inherent risks associated with investing in crypto and the regulatory challenges that come with it, Gemini’s forthcoming IPO may well be a significant turning point in how digital assets are perceived by the public. Ready or not, the wave of IPOs from crypto exchanges is upon us, potentially reshaping the tech and finance landscape as we know it. The astute investor must be prepared for both the highs and lows of this evolving market, as Gemini’s ambitious plans unfold. It’s time for the crypto industry to showcase its potential, with Gemini leading the charge into uncharted territory.